CATEGORY > Customer Success Management

150 CSMs and Founders Reveal 7 Core and Unresolved Customer Success Challenges

Are you a founder / CS leader and wish your CS motion could be better? Do you think you still have unresolved customer success issues in your business? If yes, you are not alone. I recently spoke to 150 CS professionals and founders and found these 7 issues plaguing them. If you are looking to streamline your customer success or are planning to get a CS tool, read on.

Introduction

First, a little flashback - a while ago, I decided to quit my super plush job and start again (read that story here). I was pretty sure that I wanted to build something in the Customer Success space. After all, retaining customers and keeping them happy is a tall order and SaaS businesses would sure appreciate the role of customer success in this. Having run a SaaS business from the ground up till an M&A had given me a clear glimpse of customer success.

So, I had a thesis in mind about this space.

I planned to reach out to my network and speak to 20-odd folks to validate my customer success thesis. Little did I know that I was in for a mother of scope creep. What started as a 1-month 20-odd interview roaster, ballooned to 150 people and 6 months and over 400 hours of discussions!

Insights from 150 Customer Success Managers and Founders

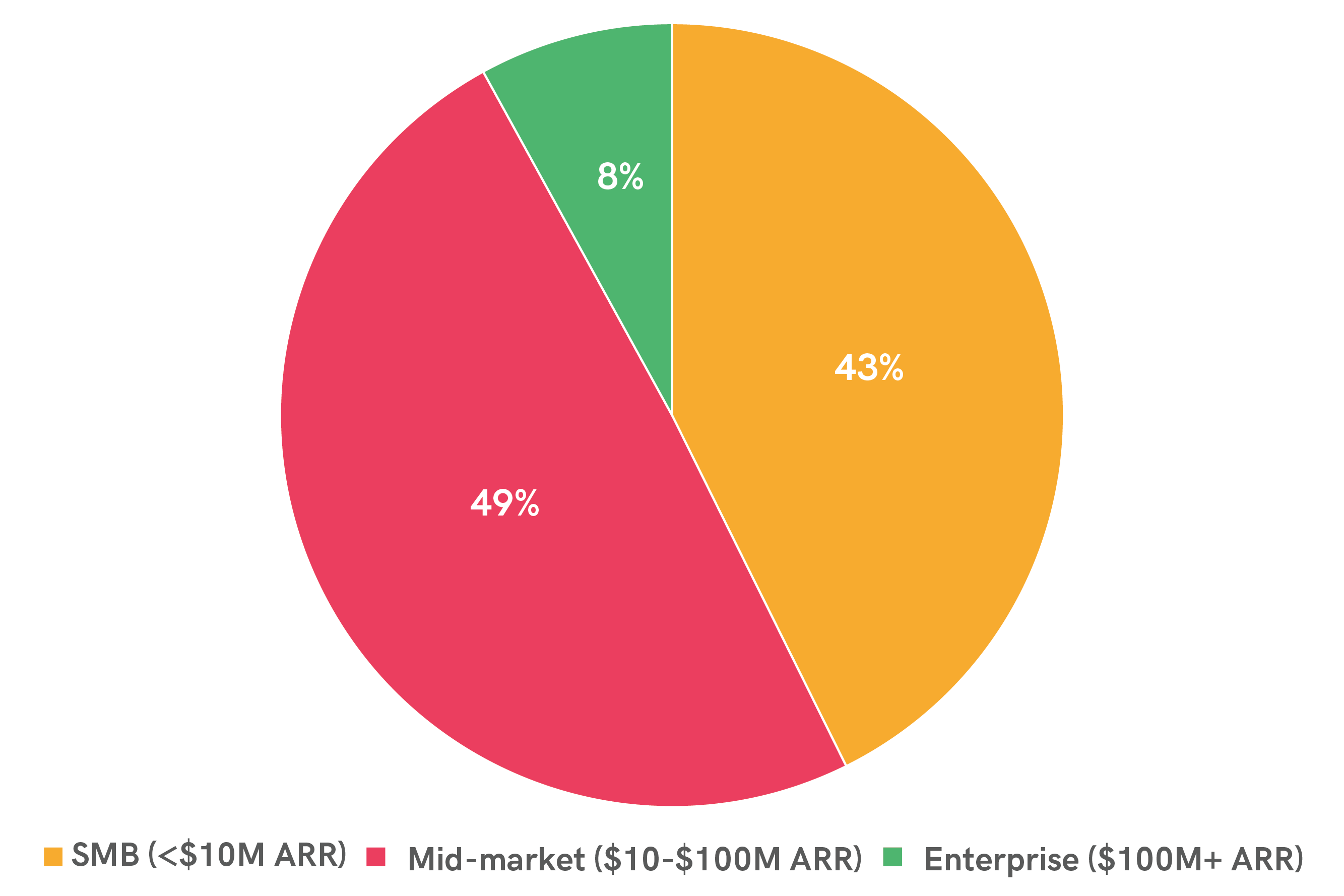

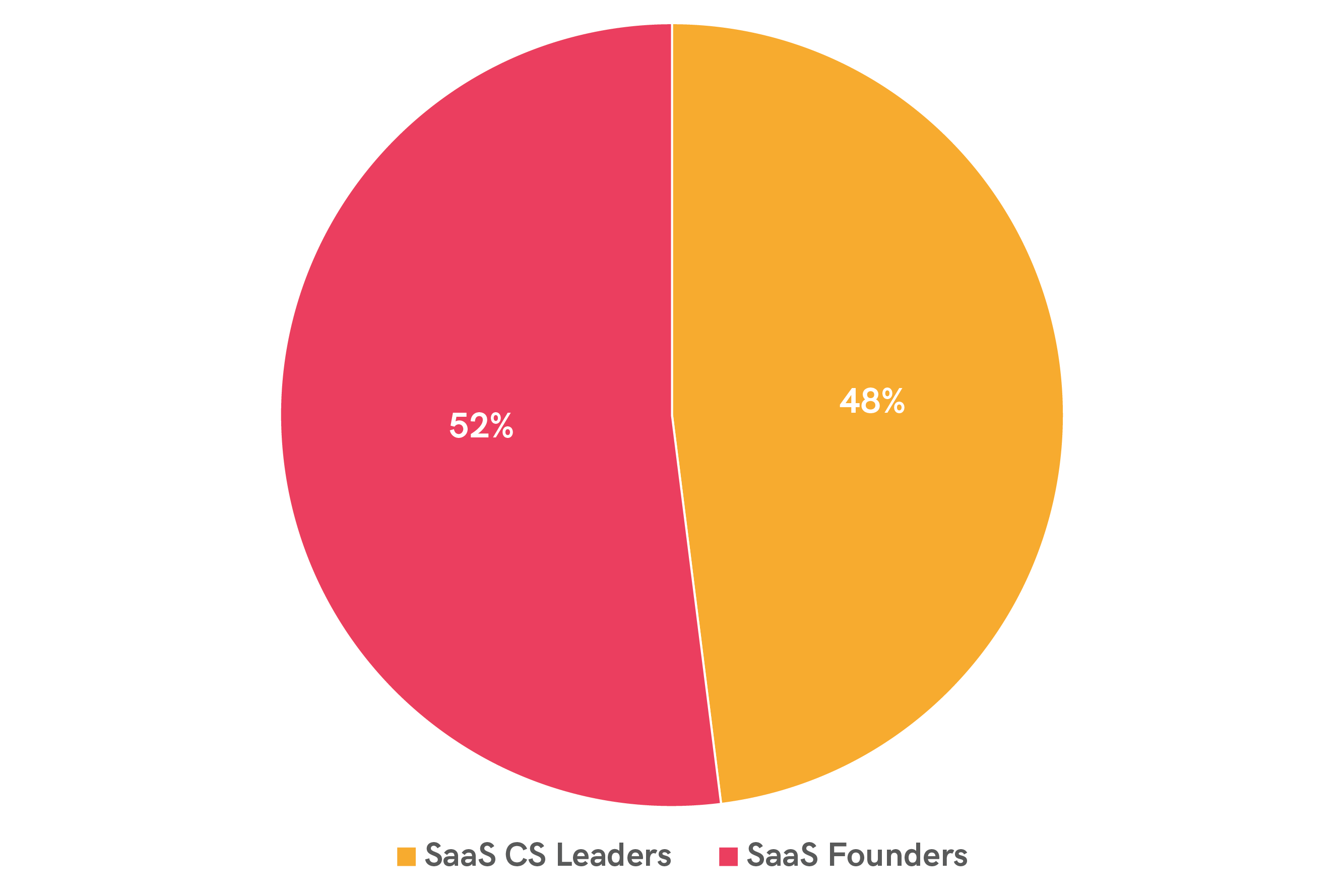

Before I proceed, let me give the breakdown of the folks I spoke to. Mostly, I spoke to CS Leaders/Founders who are SMB (<$10M ARR) and Mid-market ($10-$100M ARR). I got a few Enterprises too (>$100M ARR).

Also, all the people and the organizations I spoke to had an existing Customer Success tool in their hands.

Okay, now that we have the persona and size of the organizations covered, let's go straight to the insights. It was a goldmine of information and in this blog, I will discuss the top 7 unresolved CS issues. So, hang tight, and let's get on.

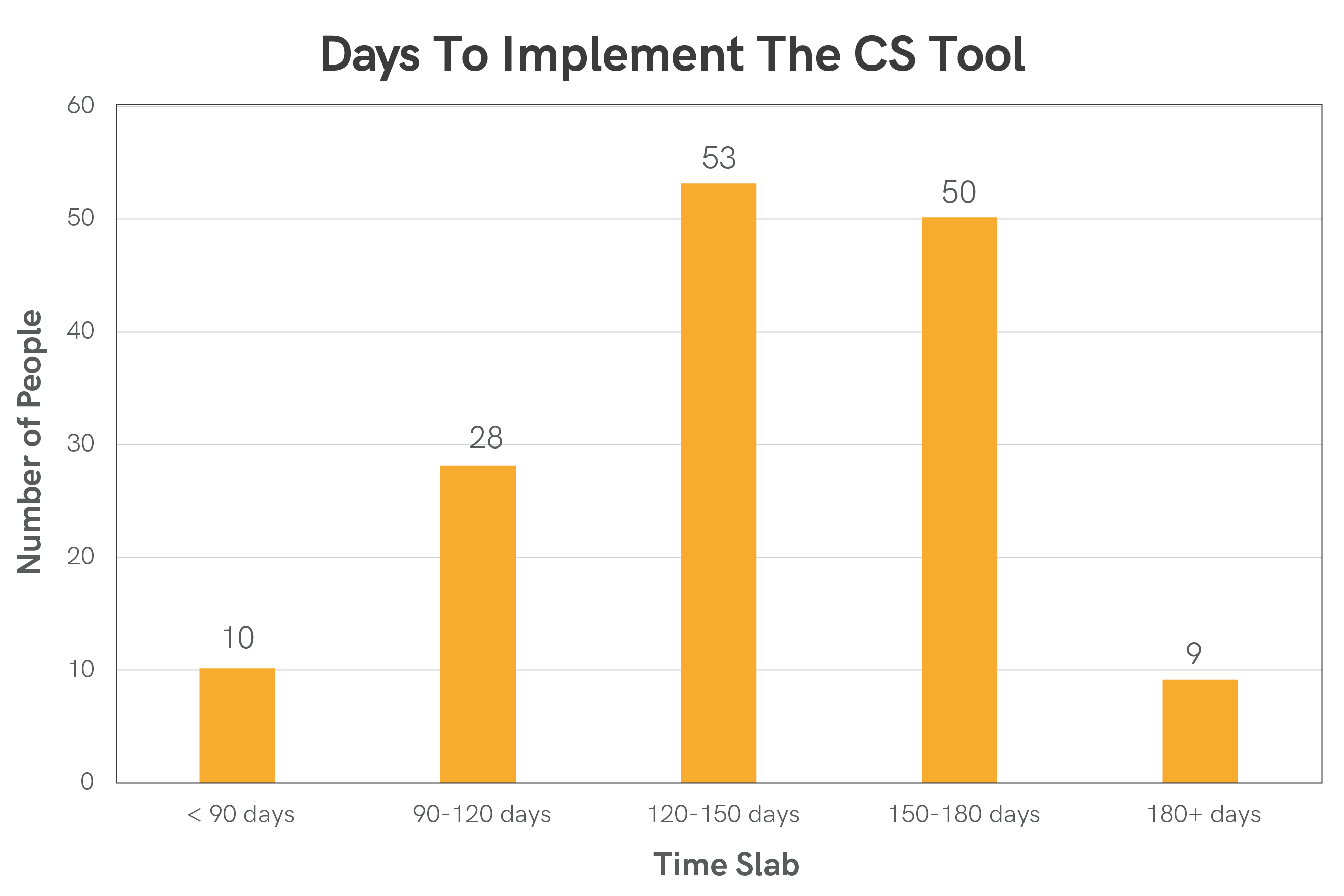

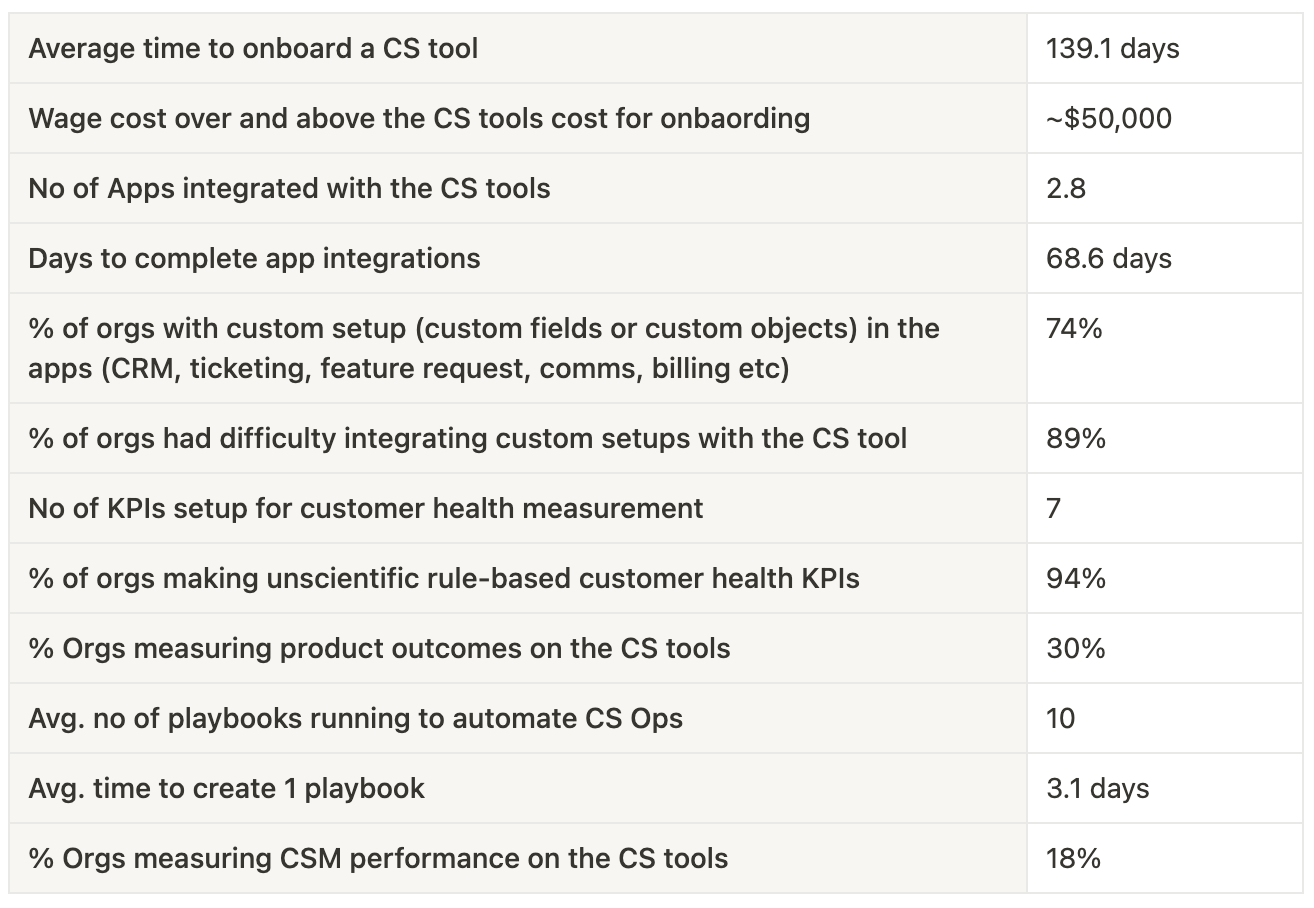

Problem #1: Customer Success Tools Take 139.1 Days To Implement at a $50,000 Wage Cost!

This is huge. The cost of doing a 139.1-day implementation in man-hour wages is big. If we assume 3 people get involved from an organization in implementation activities, at an average wage of say $15,000 per month with as little as 2 hours a day, the cost of implementation alone is around $50,000! This is over and above the tool cost.

Please note, that the time to implement is when three things happen:

- The SaaS business integrates its apps with the CS tool

- The SaaS business can see its customers’ health on the CS tool

- The SaaS business can create at least 1 playbook on the CS tool

As you can see, this is a major bottleneck. The implementations must be faster.

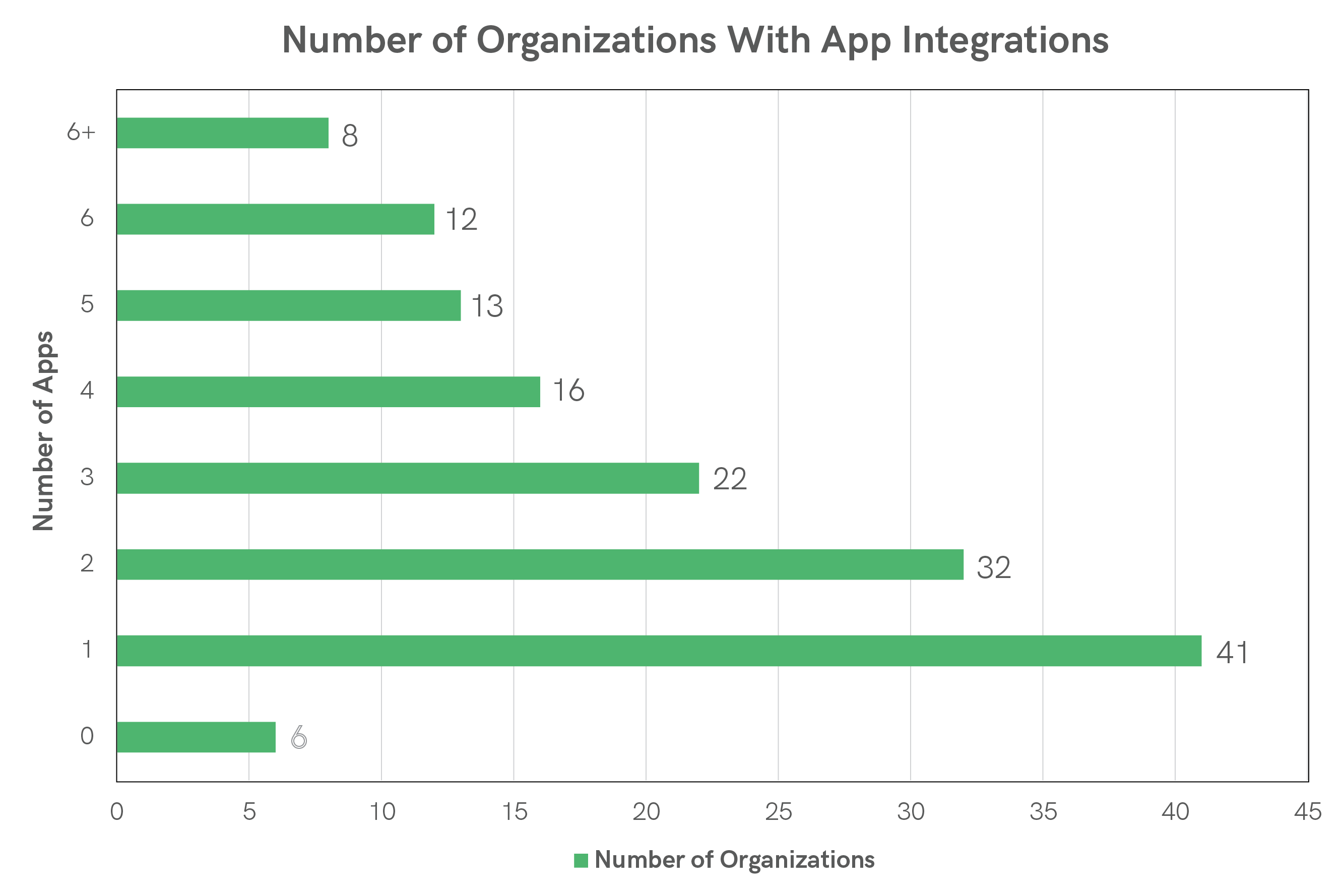

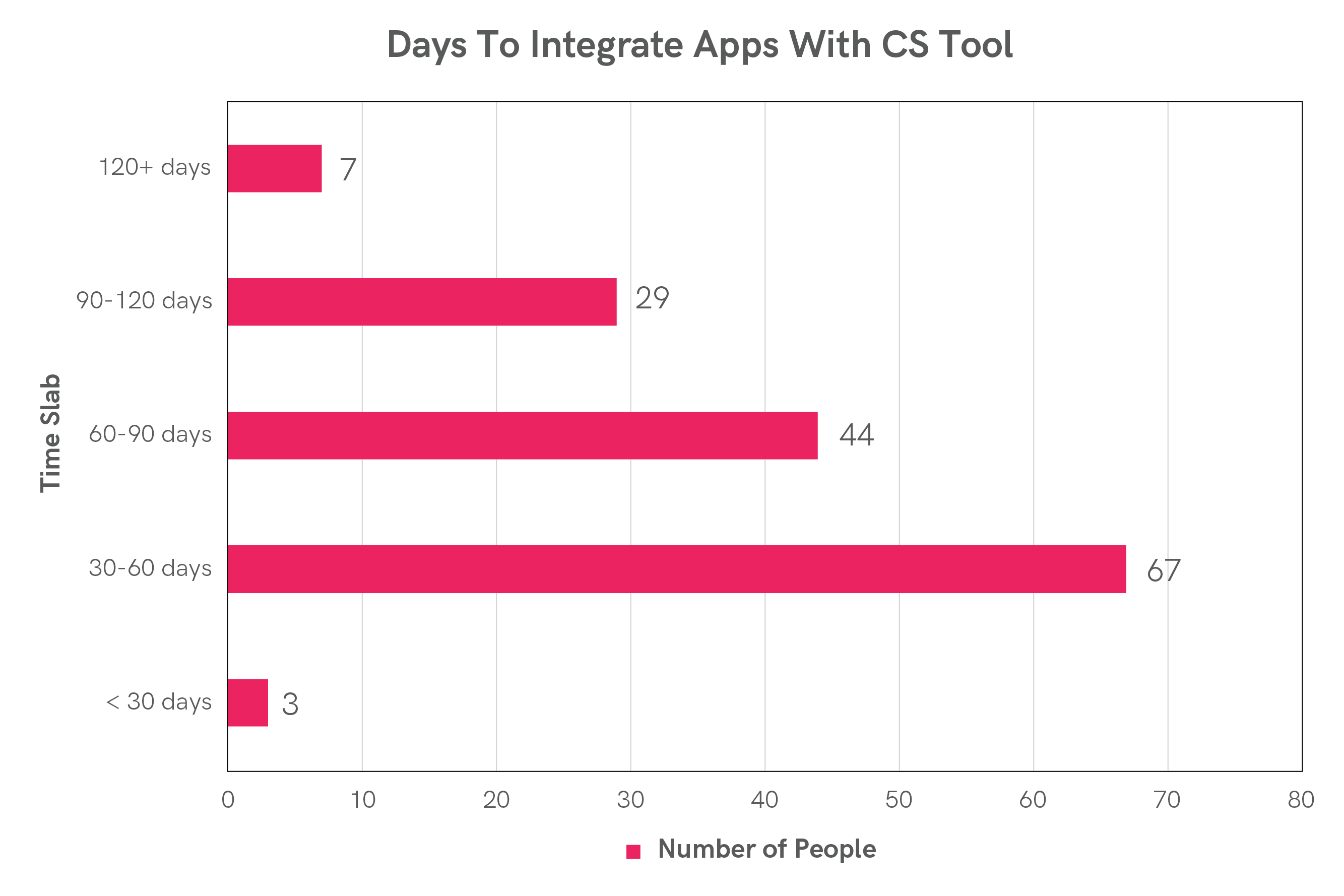

Problem #2: Data Integration Takes 68.6 Days and 2.8 Apps Are Integrated With The CS Tool

CS tools need to integrate data from a variety of sources:

- Product Analytics Apps (Mixpanel, Segment, Amplitude, etc.)

- CRM Apps (Salesforce, Hubspot, Zoho, Pipedrive, etc.)

- Ticketing Apps (Freshdesk, Zendesk, Zohodesk, ServiceNow, etc.)

- Feature Request Management Apps (JIRA, ProductBoard, etc.)

- Billing and Subscription Management Apps (Stripe, Chargebee, Zohobooks, etc.)

- Communication Apps (Gmail, Outlook, Slack, Intercom, MS Teams, etc.)

- Data Lake Source Apps (Redshift, Snowflake, etc.)

This means most of the CS tools are using CSV integrations for most of the integration sources. This is a serious challenge for the CS tools and also for the businesses who have to put in manual efforts to get data into the CS tools. 4% of the respondents (6 organizations) have 0 apps integrated and rely fully on CSV uploads!

And something more eye-opening came up in these conversations.

Clearly, data integration is the biggest chunk of time for implementations.

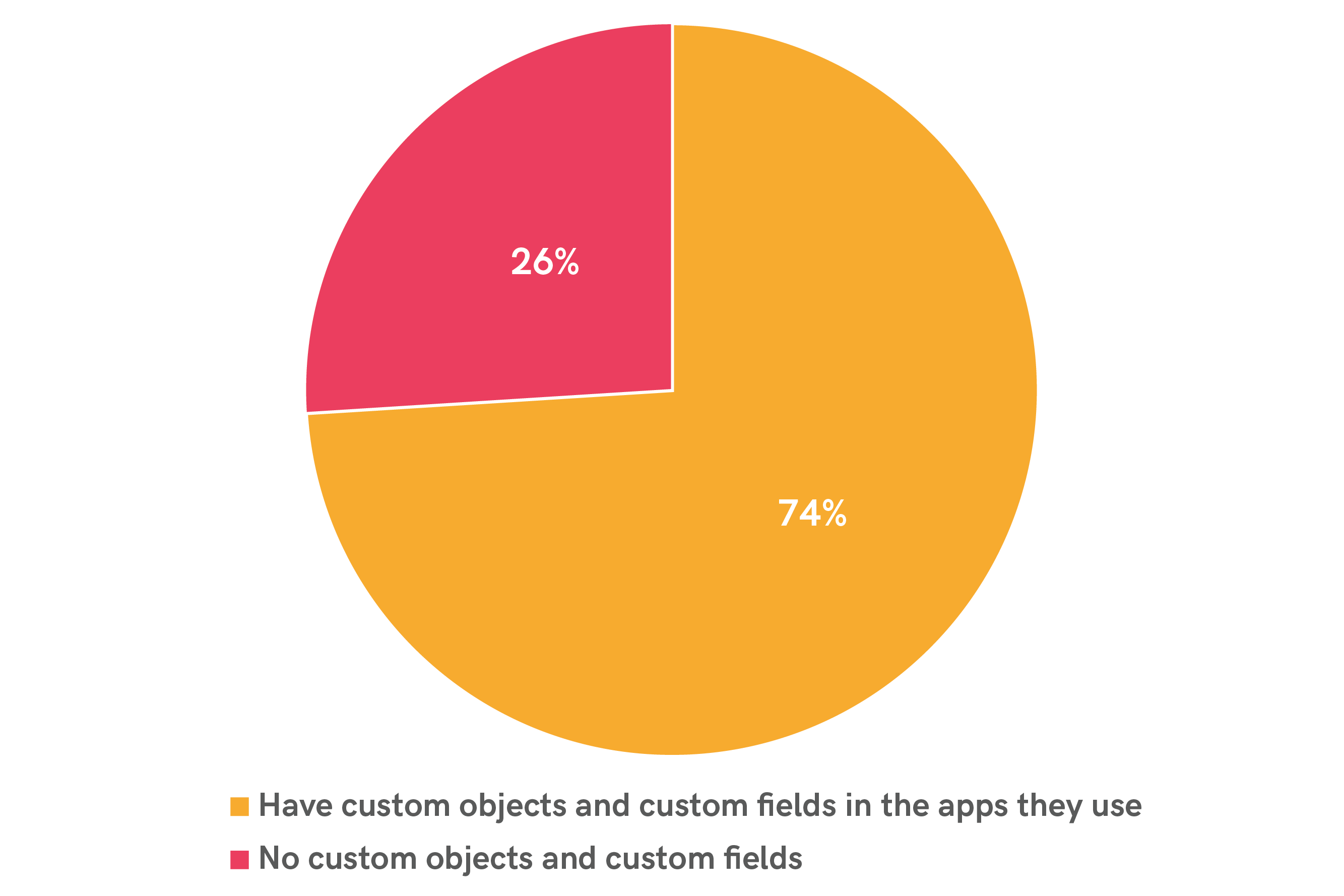

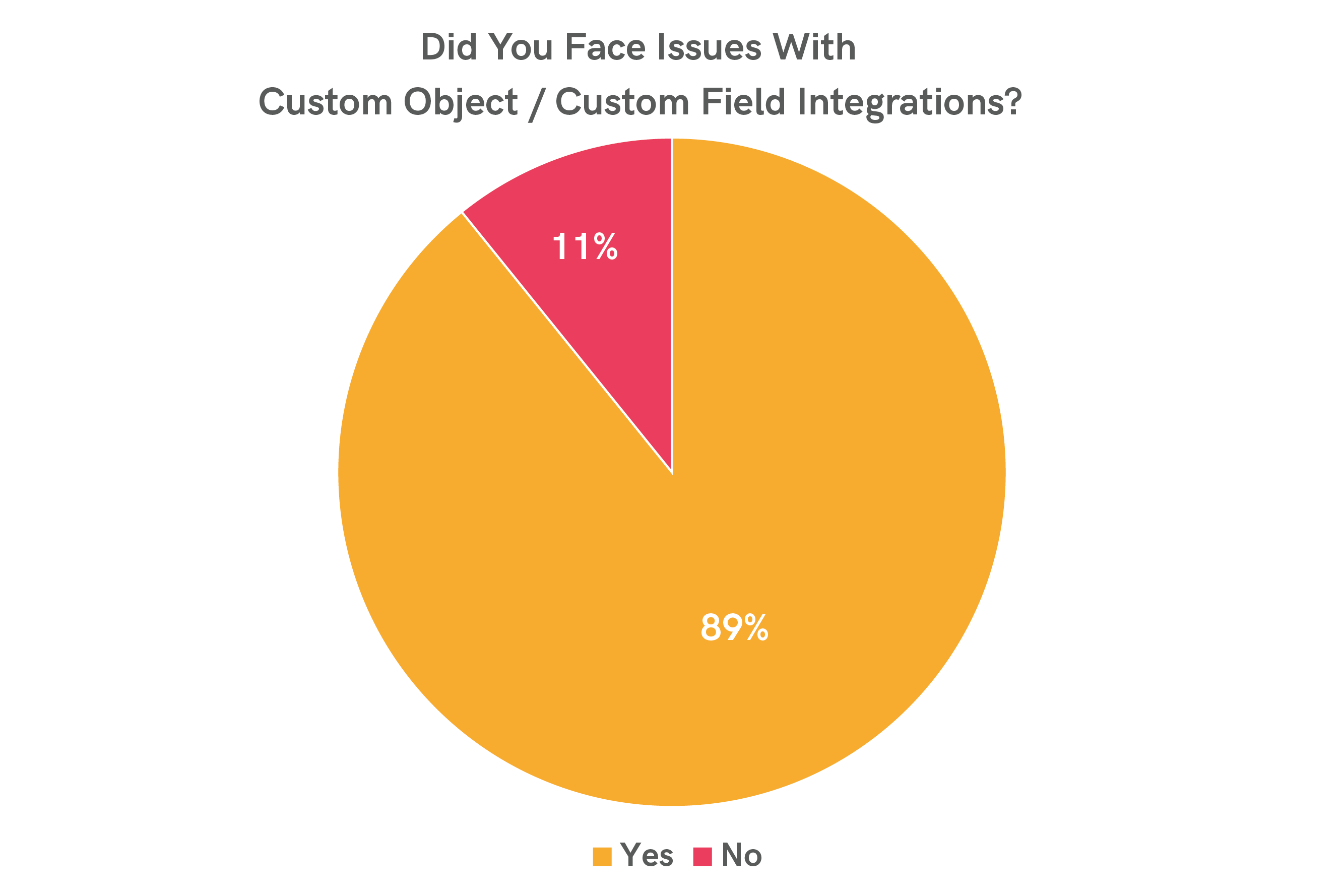

If a SaaS business has many custom objects and custom fields in their apps, the integrations become super complex and mostly fail and the only way to get data back into the CS tool becomes the ubiquitous CSVs. With only 2.8 apps per SaaS business integrated, it is clear that the CS tools are unable to integrate the apps easily and handle the complicated setup most businesses do on their app platforms.

The integrations in the CS tools work best for the vanilla implementation. However, as soon as an organization customizes the apps for their internal use, the CS tools have a hard time integrating with these customized changes.

This wasn't comforting to hear. Digging deep I found that during the CS tool selection process, this was never a selection criterion and it came as a surprise during implementations.

Problem #3: Mapping Customers Across Apps is Super HARD!

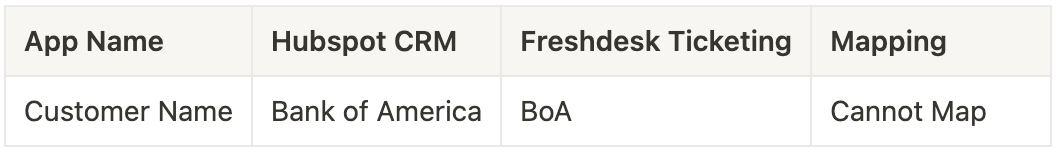

The next problem is mapping customers across apps. Let’s explain this with a simple example.

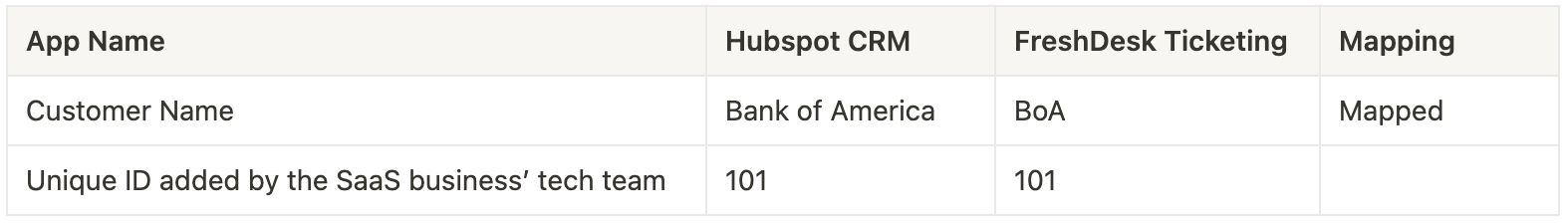

Say, you have HubSpot CRM and Freshdesk Ticketing. In HubSpot, you have a customer named Bank of America. The same customer is called BoA in Freshdesk. How do you tell the CS tool that Bank of America is the same as BoA?

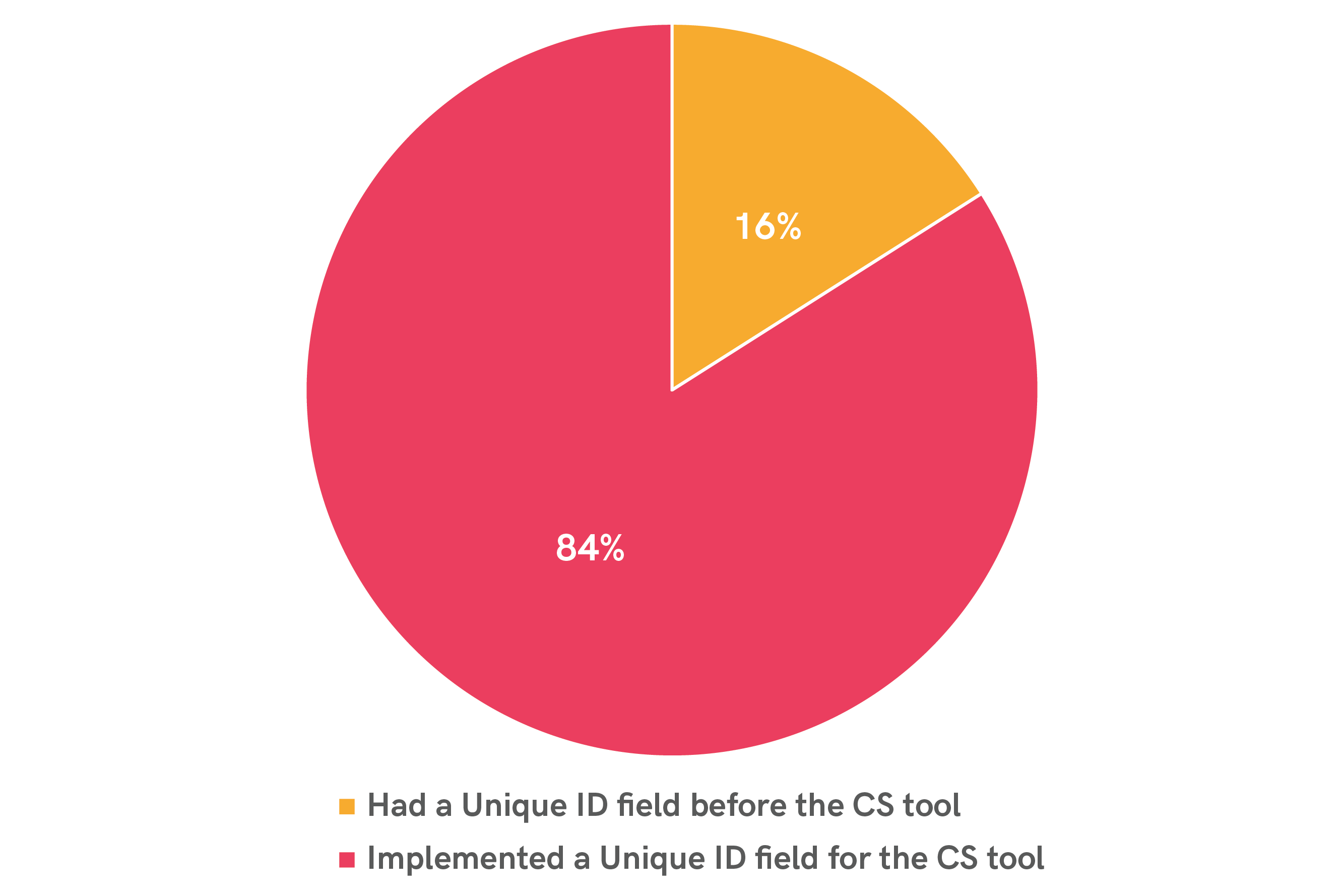

The way the CS tools solve this is by asking the SaaS businesses to create a new unique ID field in both apps for all customers. This unique ID maps the customers across apps.

Now imagine you have 1000 customers and 5 apps. Your tech team needs to add 1000 Unique ID fields across 5 apps = 5000 ID fields need to be added. This is a huge dev effort that comes to bite the SaaS organization that is implementing a CS tool.

And this takes a lot of time and cost. It requires tech bandwidth and makes the process super long and hard.

Again, digging deep I found that during the CS tool selection process, this was never a selection criterion and it came as a surprise during implementations.

Problem #4: Building Customer Health is Super HARD!

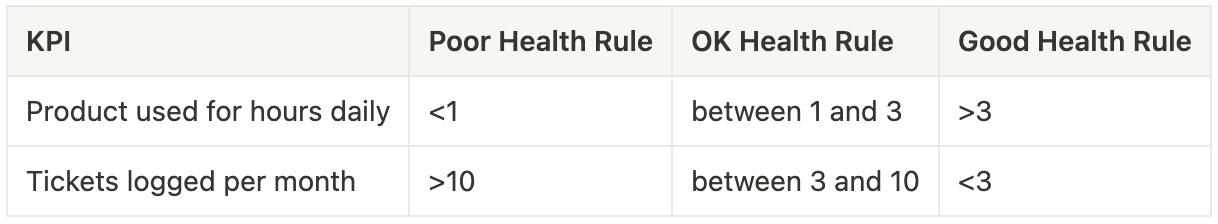

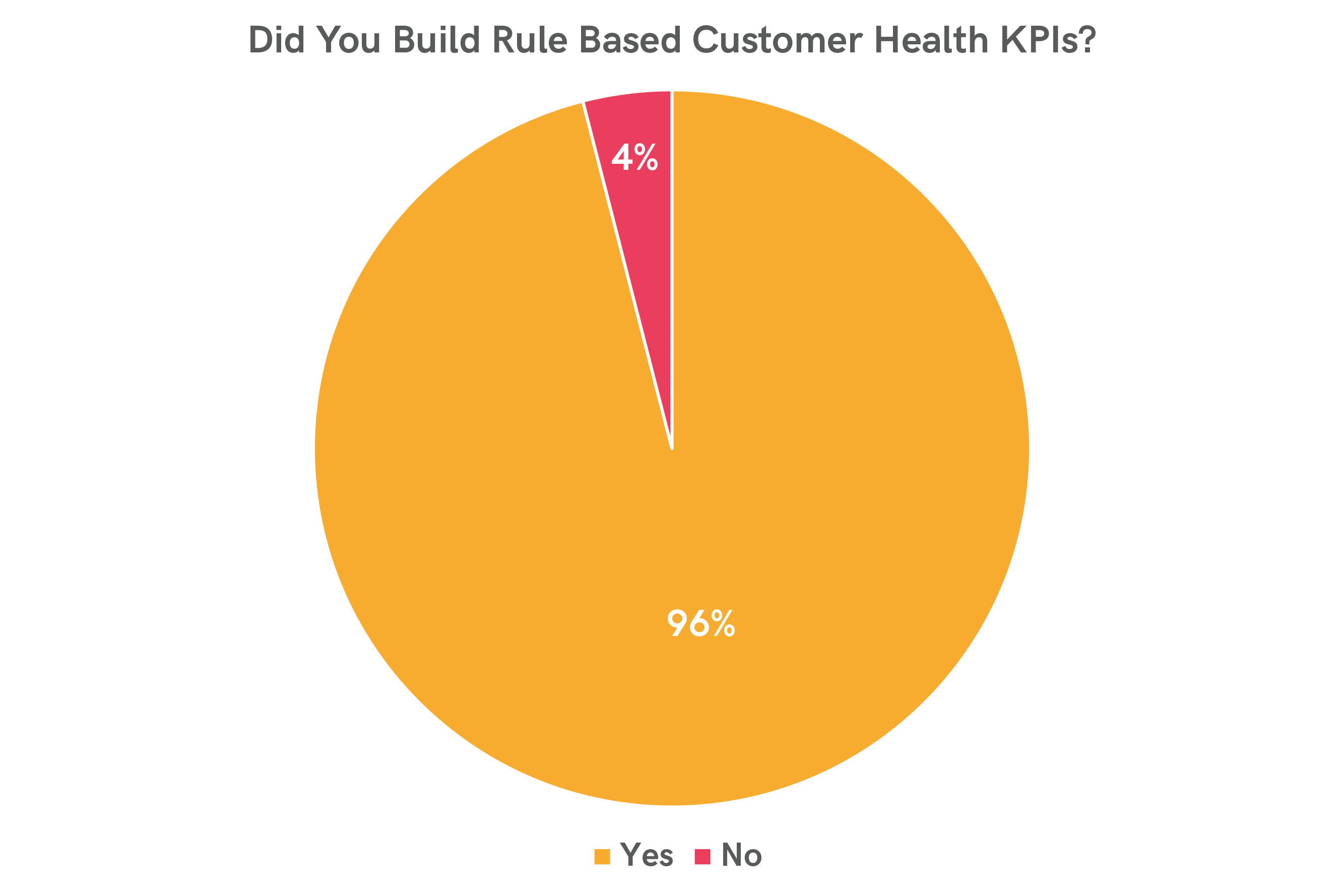

Customer Health is a thorny issue. Most of the folks with whom I had a conversation had created rule-based health. They look like the following:

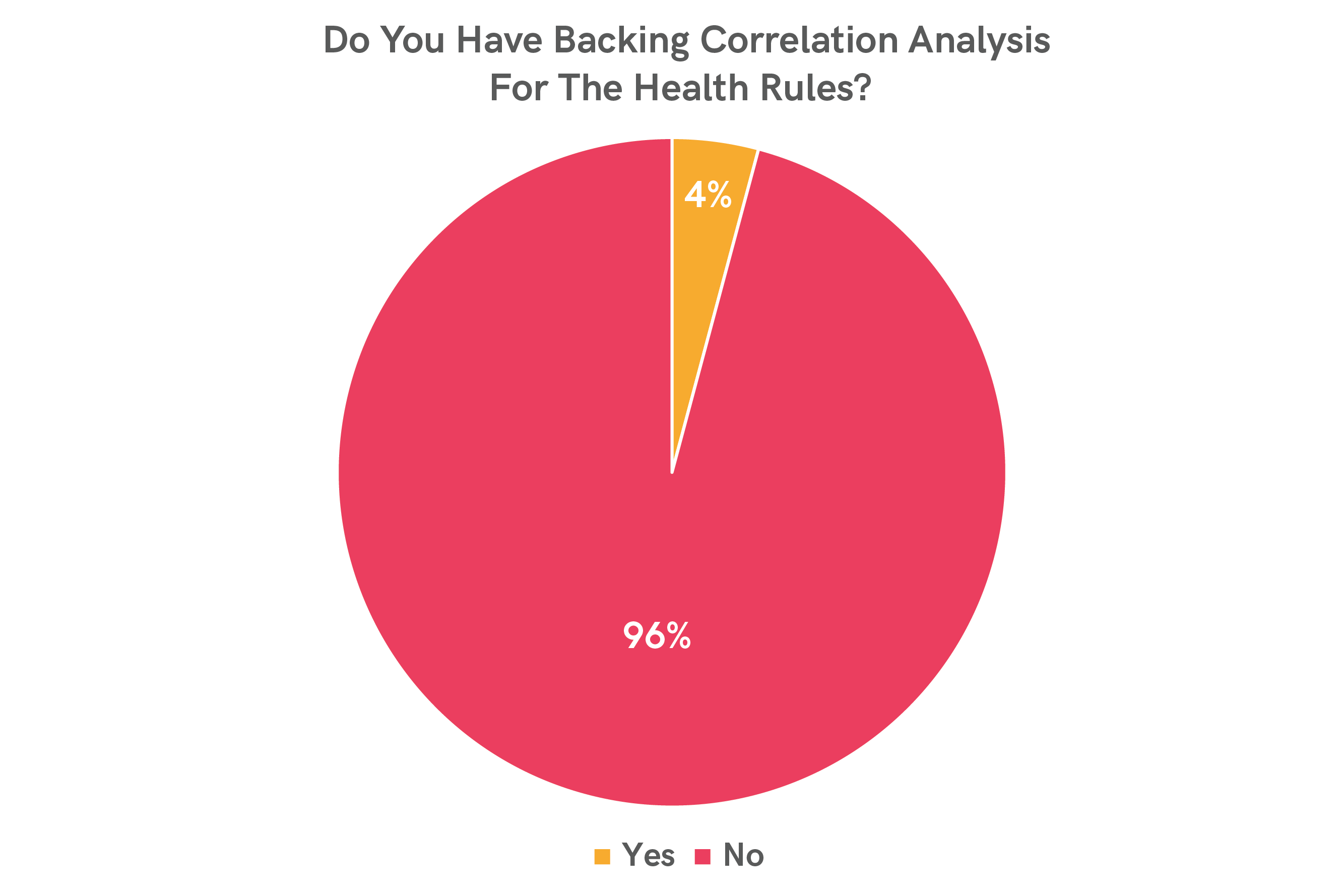

The problem is, that there is no backing correlation analysis that a customer’s health remains good with, say, greater than 3 hours of daily usage OR a customer churns after less than 1 hour of daily usage.

This makes these rules look and feel number-based but are fully gut-driven and unscientific because they lack any backing evidence.

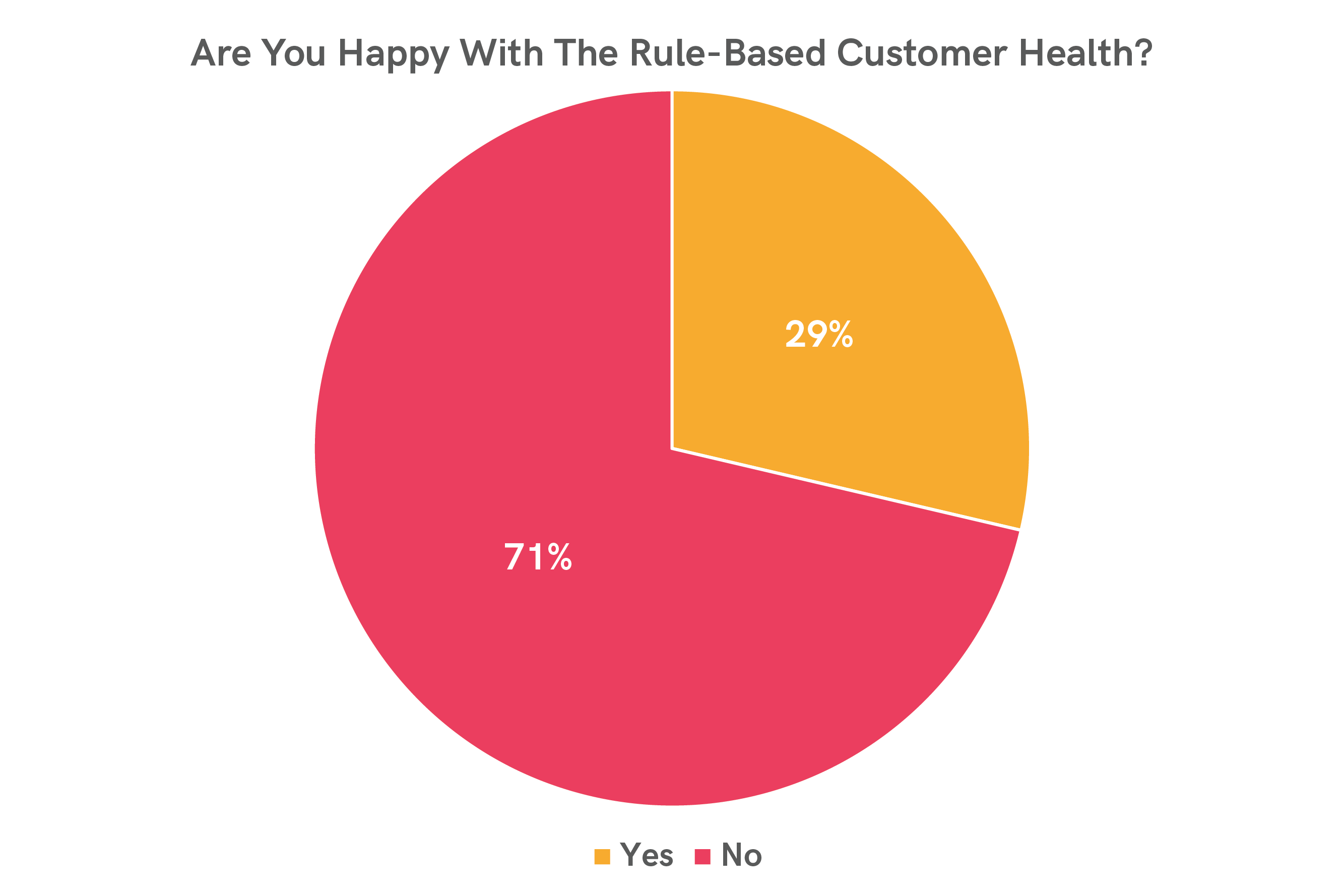

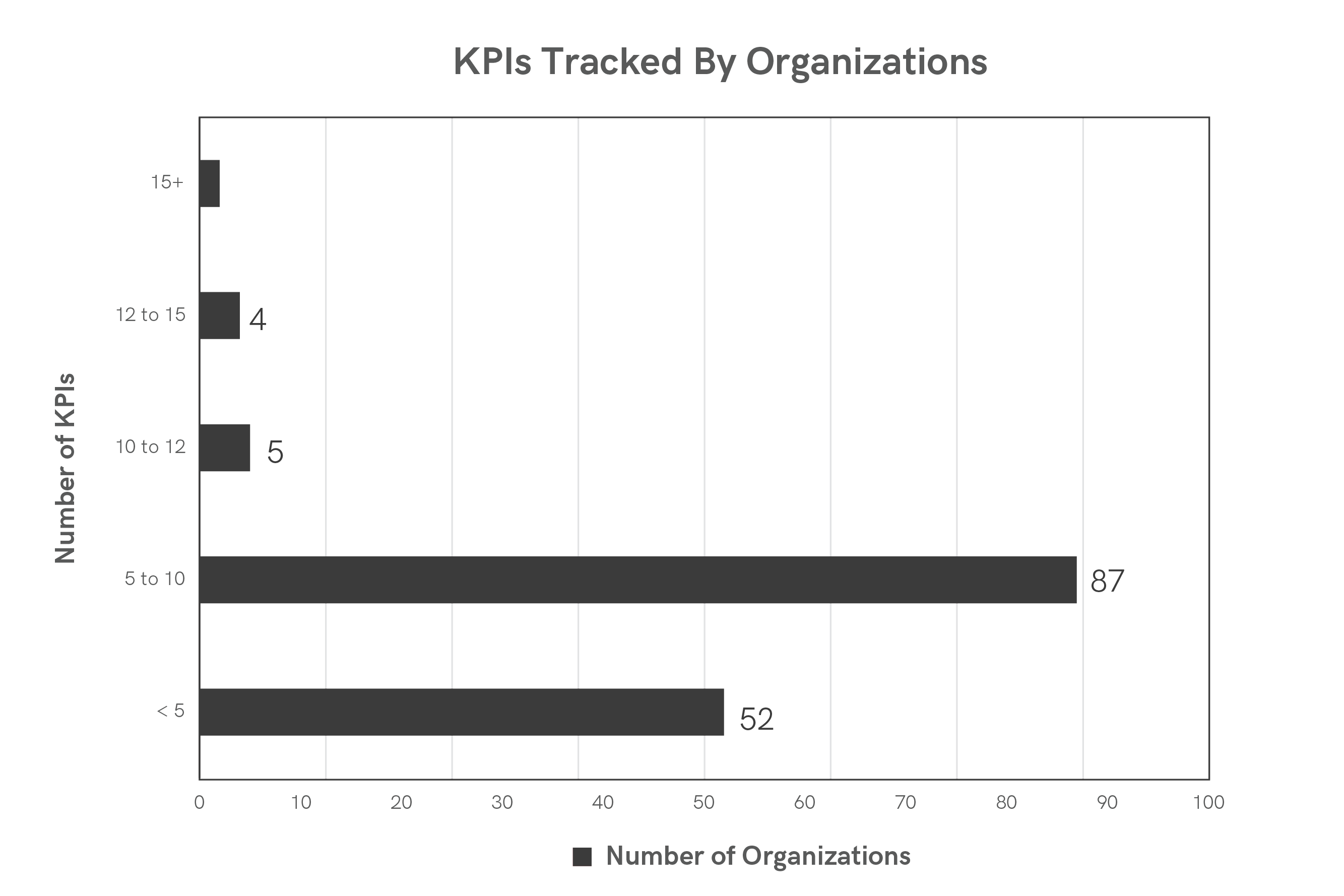

Another point is creating these health KPIs takes a lot of time. The CS team goes for a wild goose chase to find the correlations of data for a while and then they give up and settle for the rule-based KPIs. When asked if they think the rule-based health determination is scientific, a large majority didn’t agree but they also expressed helplessness that there were no other methods available.

In conclusion, I found that people are tracking very few rule-based KPIs that they know are not very scientific.

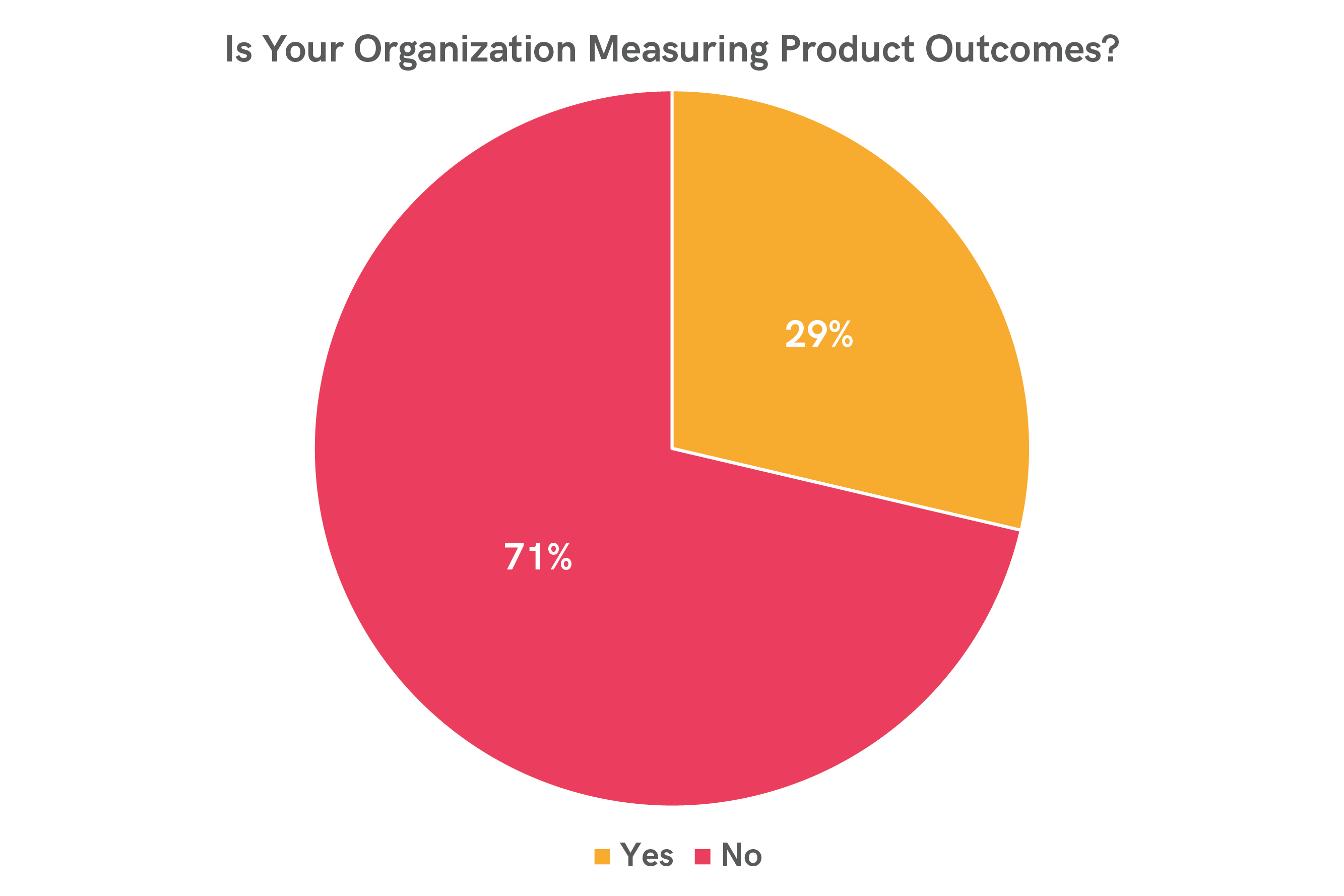

Problem #5: There is no easy way to measure product outcomes for the customers

Product outcomes are the most important indicators for a CS team to gauge if a customer is indeed deriving value from the product and services offered to the customer. A customer’s retention heavily depends on the product outcomes they are getting. It seems there is no easy way to measure that in the current breed of CS solutions.

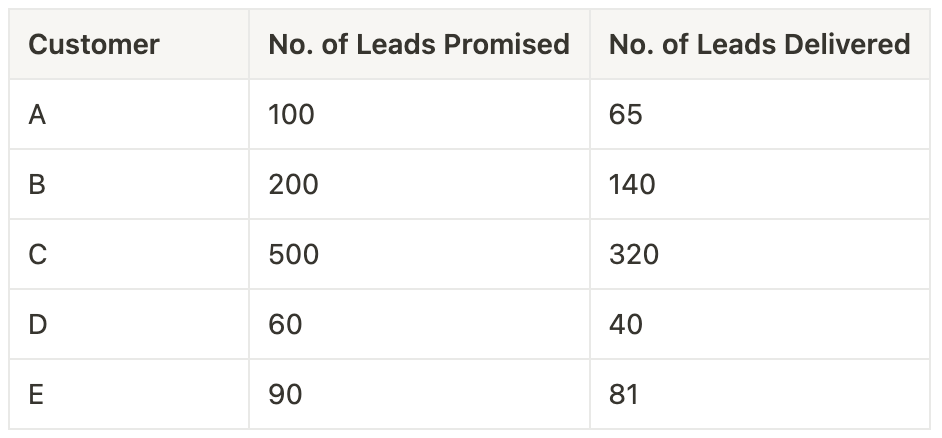

Imagine a marketing automation platform. Say, their major value is sending a bunch of qualified leads to the marketing and sales team by scraping data from a bunch of online sources (G2.com, LinkedIn, etc.) Say, the business has promised its customers monthly targets of qualified leads and then wants to measure the health of this outcome.

It is hard to send this data point from the product database to the CS tools and include them as health parameters. The rule-based system again fails here because each customer has a different base to compare the promised vs delivered.

Also, this needs some consulting work with the CS solution provider and mostly some internal tech team’s bandwidth.

Problem #6: Creating Playbooks For Breach of Customer Health KPIs is HARD!

Playbooks are essential tools for the smooth running of customer success ops. Generally speaking, CS teams need to build playbooks for the various emergent scenarios that threaten customer health. These playbooks do the following things:

- They keep a lookout on customer health and lifecycle stages

- For any alarming changes, they create tasks and notifications for the CS teams to act on

- They create a SOP for the CS teams to resolve the issue

The CS teams create playbooks for these 14 emergent scenarios:

- Customer Inactivity Playbooks → steps to do when a customer or user becomes inactive on the SaaS platform

- Poor Product Usage Playbooks → steps to do when a customer’s or user’s product usage takes an alarming dip

- Poor Ticketing Playbooks → steps to do when a customer’s ticketing takes a sharp uptick

- Poor Feature Request Health Usage Playbooks → steps to do when a customer’s product feature requests show an alarming spike

- Poor Communication Health Playbooks → steps to do when a customer’s comms takes an alarming dip

- Poor Payment Track Record Playbooks → steps to do when a customer’s payment track record shows irregularities

- Upcoming Renewals Playbooks → steps to do when a customer is nearing the renewal marker to ensure a successful renewal

- Upcoming QBR Playbooks → steps to do when a customer is nearing the quarterly business review (QBR) marker

- Upcoming Upsell Playbooks → steps to do when a customer shows signs of upsell

- Churn Threat Playbooks → steps to do when a customer shows churn risk

- Business Specific Playbooks → steps to educate/train/monitor customers

- Referral Specific Playbooks → steps to get referrals from customers

- Feedback/Survey Type Playbooks → steps to get customer feedback (NPS, CSAT, etc) from customers

- Getting Favorable Reviews Playbooks → steps to get favorable customer reviews (via G2, Capterra, Case Studies, Testimonials, etc.)

As you can see, this is quite a heavy task and it takes the CS teams a lot of time to set up and run playbooks to automate their CS operations.

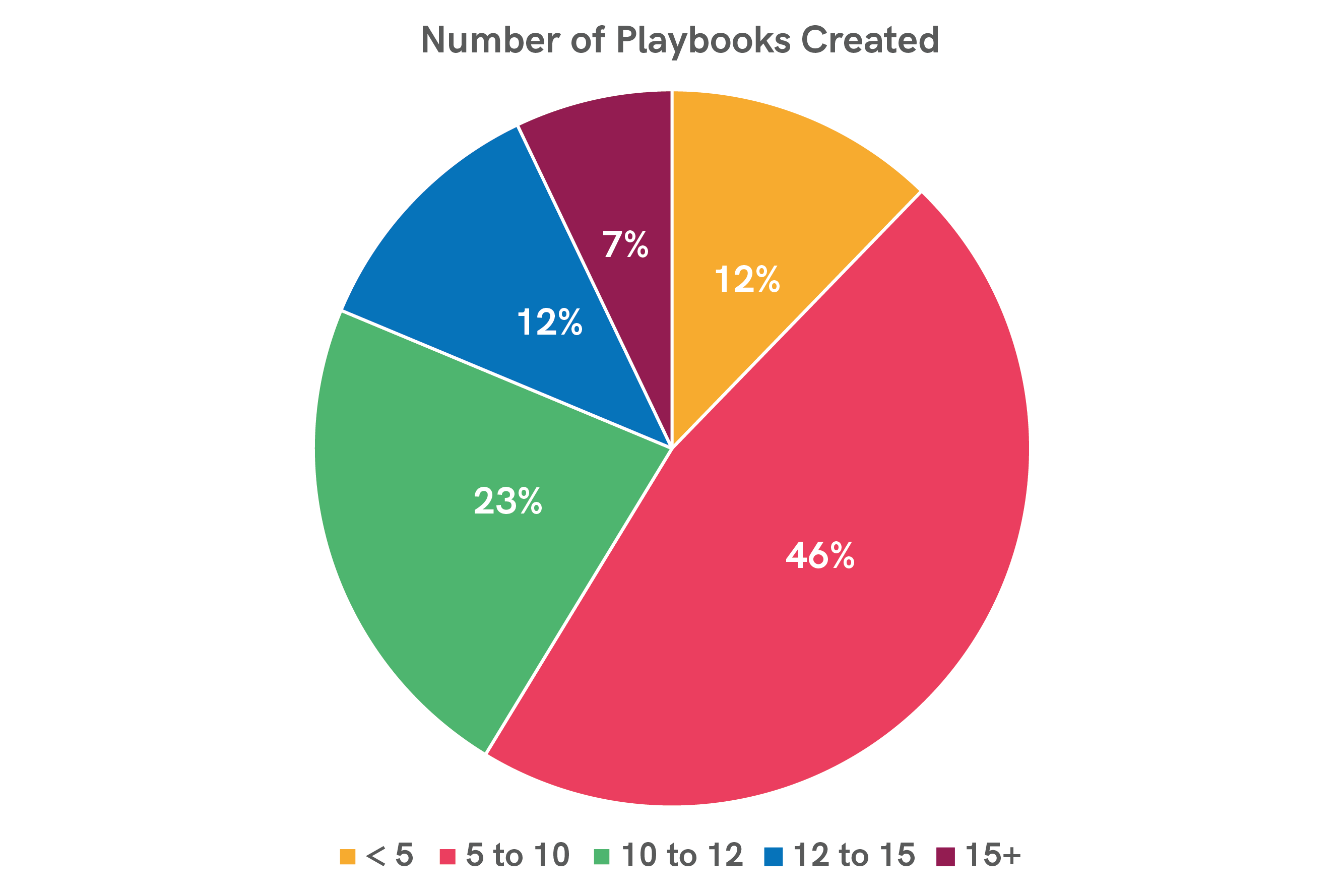

This is certainly low. There are 14 types of scenarios and even if a CS team creates just one playbook for each scenario, there should be at least 14 playbooks.

This tells us that the organizations are unable to create playbooks to cater to all emergent scenarios and thus many such cases are handled outside the CS tool.

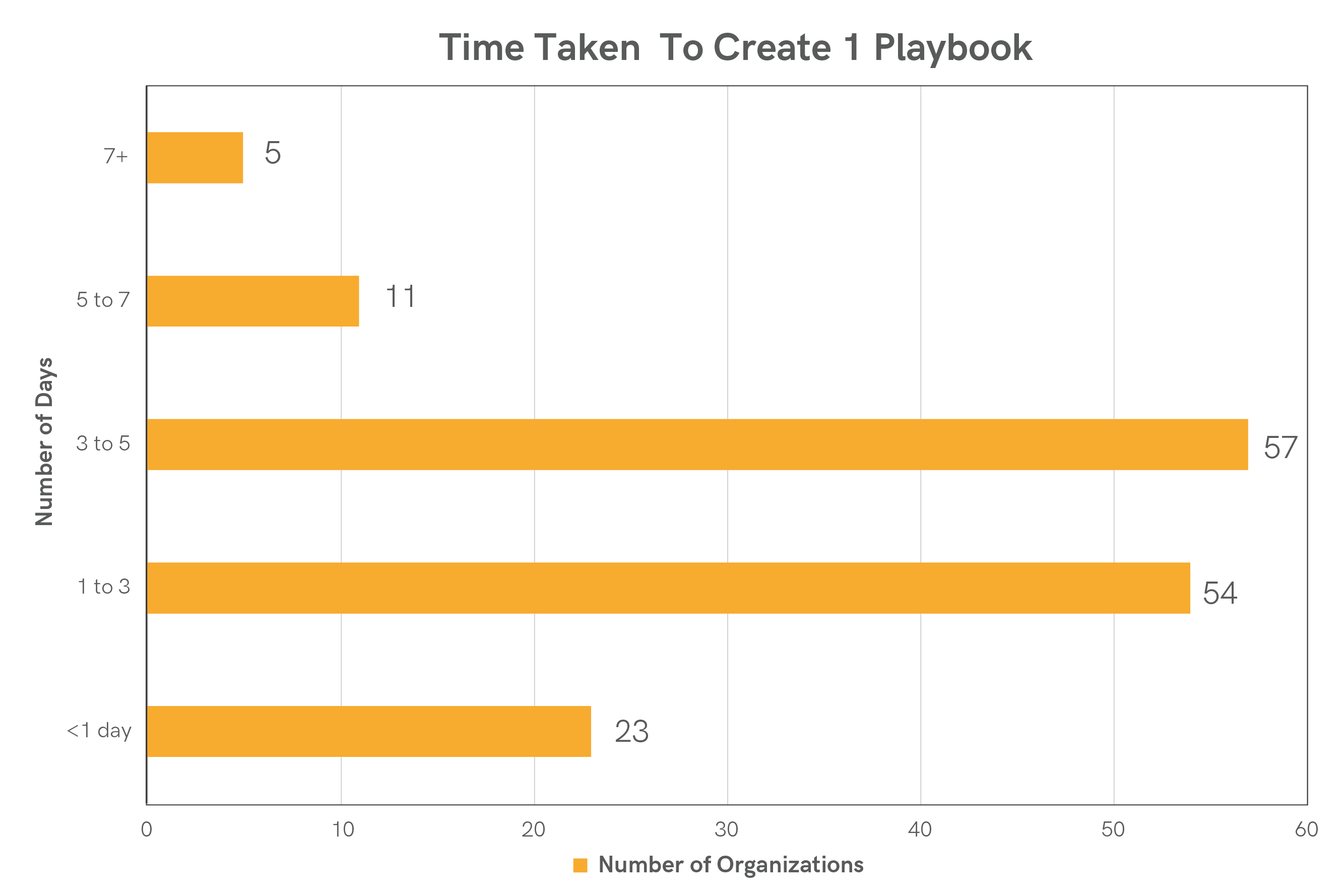

So, this is a major drain on the CS team’s time creating these playbooks.

So, it seems creating playbooks takes a lot of time and the orgs take 3.1 days per playbook and a typical org creates around 10 playbooks on their CS tools. This shows evidence of this being highly effort-intensive work with low square footage of emergent scenarios covered by automation.

Problem #7: Mapping CSM performance is HARD!

CSMs are responsible for account health, churn management, upsell management, day-to-day interaction logging with customers, and a lot more. It is therefore of great value to measure the CSMs’ performance. A few things that need to be measured to find how the CSM is performing are:

- The ARR of the CSM’s customers

- The GRR of the CSM’s customers

- The NRR of the CSM’s customers

- The NDR of the CSM’s customers

- The gross churn % of the CSM’s customers

- The health profile of the CSM’s customers

- The health profile of the CSM’s users

- The time spent by the CSM on customers

Final Word

So, in a nutshell here are the findings of my 400 hours of conversations with 150 organizations’ founders and CS leaders:

Stay tuned to my blog. In the later blogs, I will go deeper into all the CS issues and show you how we have solved each of these problems in ZapScale.

ABOUT THE AUTHOR

Popular from Customer Success Management

Quality Content,

Straight To Your Inbox!

Subscribe for the latest blogs, podcasts, webinars, and events!

Write a Blog

If you have experience in CS and

a flair for writing, we’d love to

feature you.

Write to us on

hello@zapscale.com