CATEGORY > Customer Health

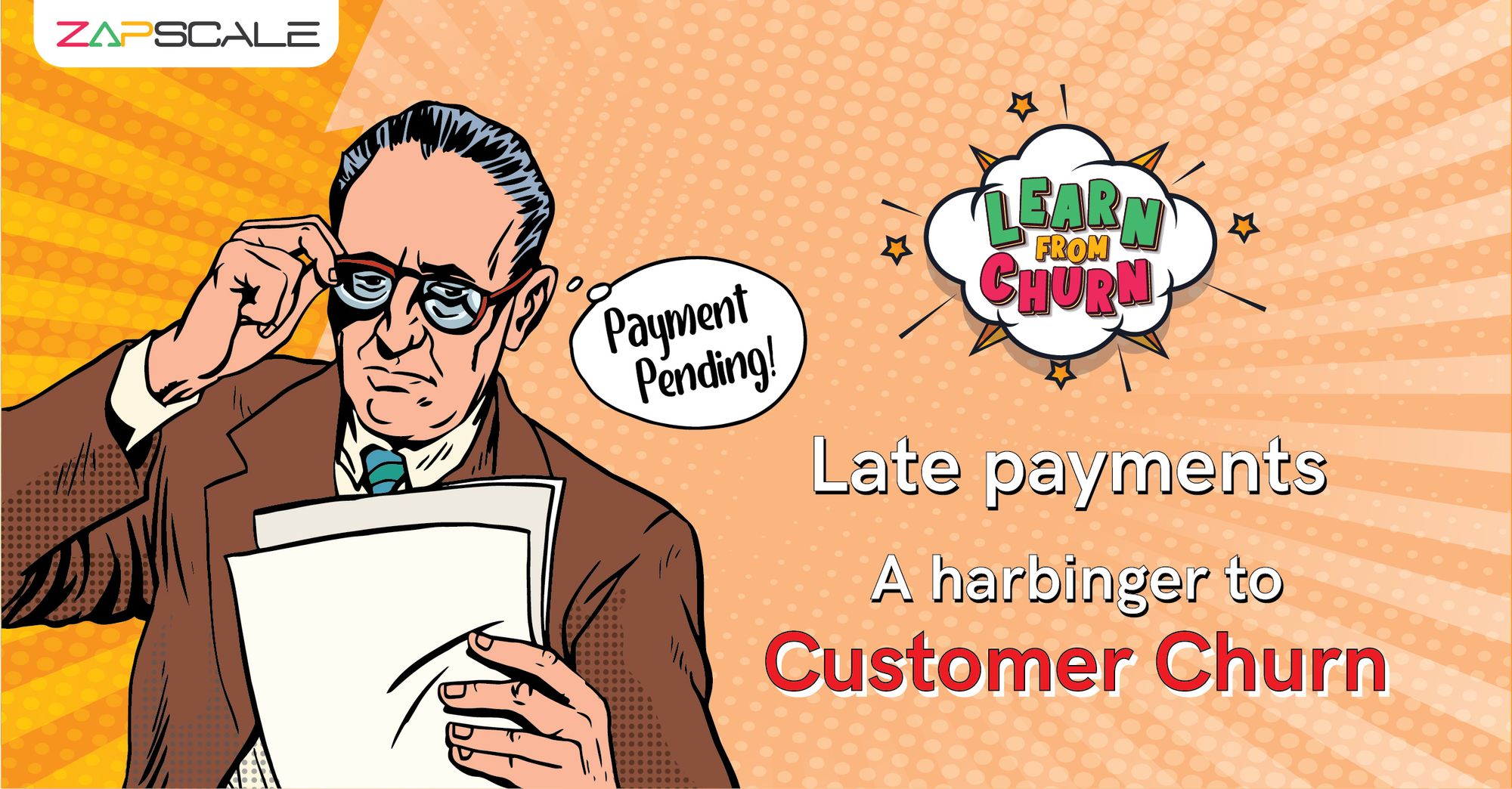

Learn from Churn #5 – Late payments

So, this is the latest post (#5) in my blog series “Learn from Churn”. In this series, I bring out the stories of customer churn from my last SaaS startup and show you how the data pointed to the possible churn but we just missed it because we had not looked into this ordinate.

In my last post, I discussed a case where we found churn to be related to inconsistent page visits by a customer. You can read it here.

So, let’s look into the next mysterious churn story: the case of late payments.

This was a smallish customer with an ACV of $25,000, based out of Thailand. Because of their smallish ACV, I hate to admit, that we were not looking at them with a magnifying glass. This was also the early days of our startup and we were still tying up the financial systems with our CRM.

Anyway, as fate would have it, the customer told us that they didn’t wish to continue anymore. As you can imagine, this made us sit up and take notice of this customer. The fun part was, that all of their vitals looked good. They were using the product well, the time spent was good, and there were not too many tickets or feature requests. So, overall they looked pretty good. There were other customers who were in the same league. None of them were threatening to churn. So, what was wrong with them? After rummaging through all the customer data, we were frustrated. There seemed to be no data point that was showing us that there was some distress.

And then, we happened to look at their payment track record with us. I am going to show you two customers’ data on the payment side.

Both of them were paying us 100% of their monthly dues. But, when we looked closely, we found something interesting. See if you can spot the customer issue?

As you can see, the Churn Threatening Customer paid us 100% monthly but they were paying us late almost always. We were happy that the payments came 100%, so no one bothered to dig deeper into the late payments.

Our customer success team interviewed the customer and found out that the customer was looking for an alternative cheaper local solution and trialing and testing the other solution while using us in parallel. It took them 4-5 months to onboard to the local cheaper solution and that was the reason they paid us late and eventually had gotten the cheaper solution sorted to the point where they could stop using us.

The lesson was clear.

It is not enough to just look at the 100% payment receipt and be content.

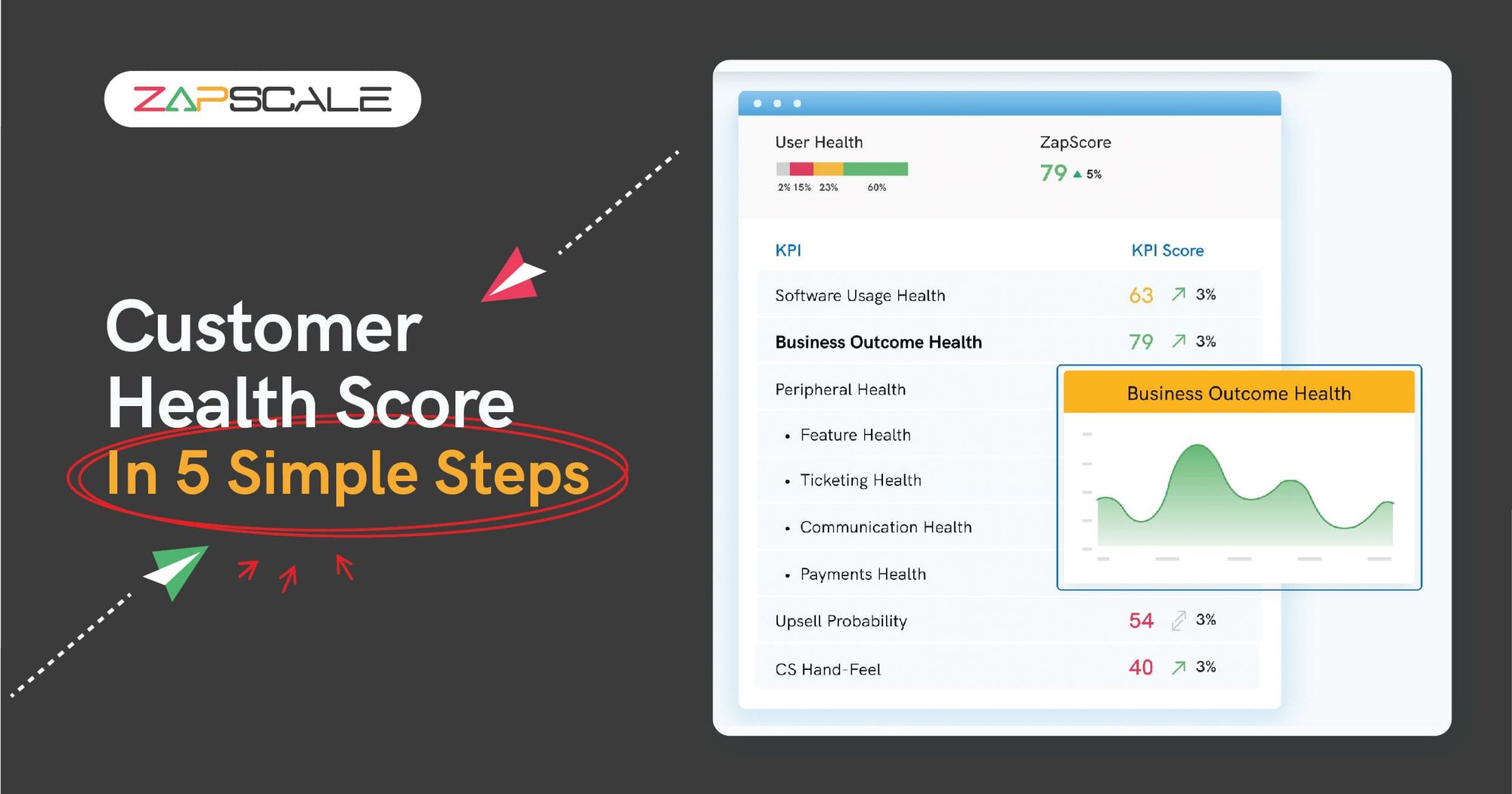

We added a new health KPI to measure the late payment trend and it showed us some interesting exception cases for some other customers that we quickly solved. We lost this Thai customer nonetheless. If we had intervened earlier with an early warning of the late payments, we could have salvaged this customer.

Learn from Churn: Lesson 5

A successful customer pays in full and pays on time.

In my next post, I will be giving an example of a churn threat where the customer’s email data showed us the way to predict churn.

ABOUT THE AUTHOR

Popular from Customer Health

Quality Content,

Straight To Your Inbox!

Subscribe for the latest blogs, podcasts, webinars, and events!

Write a Blog

If you have experience in CS and

a flair for writing, we’d love to

feature you.

Write to us on

hello@zapscale.com