CATEGORY > Customer Health

Learn from Churn #6 – Un-replied Emails

I am a 2nd time SaaS founder. I built scaled and sold my last startup and now building a customer success solution for SaaS. This is a series of blogs where I recall the stories of churns and churn threats that we had in our last startup. Each incident taught us valuable lessons in monitoring our customers and I am happy to bring them to you.

This is the 6th post in the series. In my last post, I discussed a case where we found churn to be related to late payments by a customer. You can read it here.

So, let’s look into the next mysterious churn story: The case of un-replied emails

This was a mid-sized customer with an ACV of $40,000, based out of Singapore. After being our customer for 3 years, they told us that they were moving on. By that time we had created an org-wide sentiment of taking churn as a personal loss. The whole organization would respond to churn threats like our bodies fight infections – it is a life and death issue – it is an all-hands-on-the-deck fight.

Our customer success team dug through the customer’s data to find the data-driven root cause of this churn threat. This was a ritual that has served us well and we had over 30 KPIs based on which we were looking at a customer’s health. For this customer, there were no red flags, and the lack of any tell-tale data baffled us.

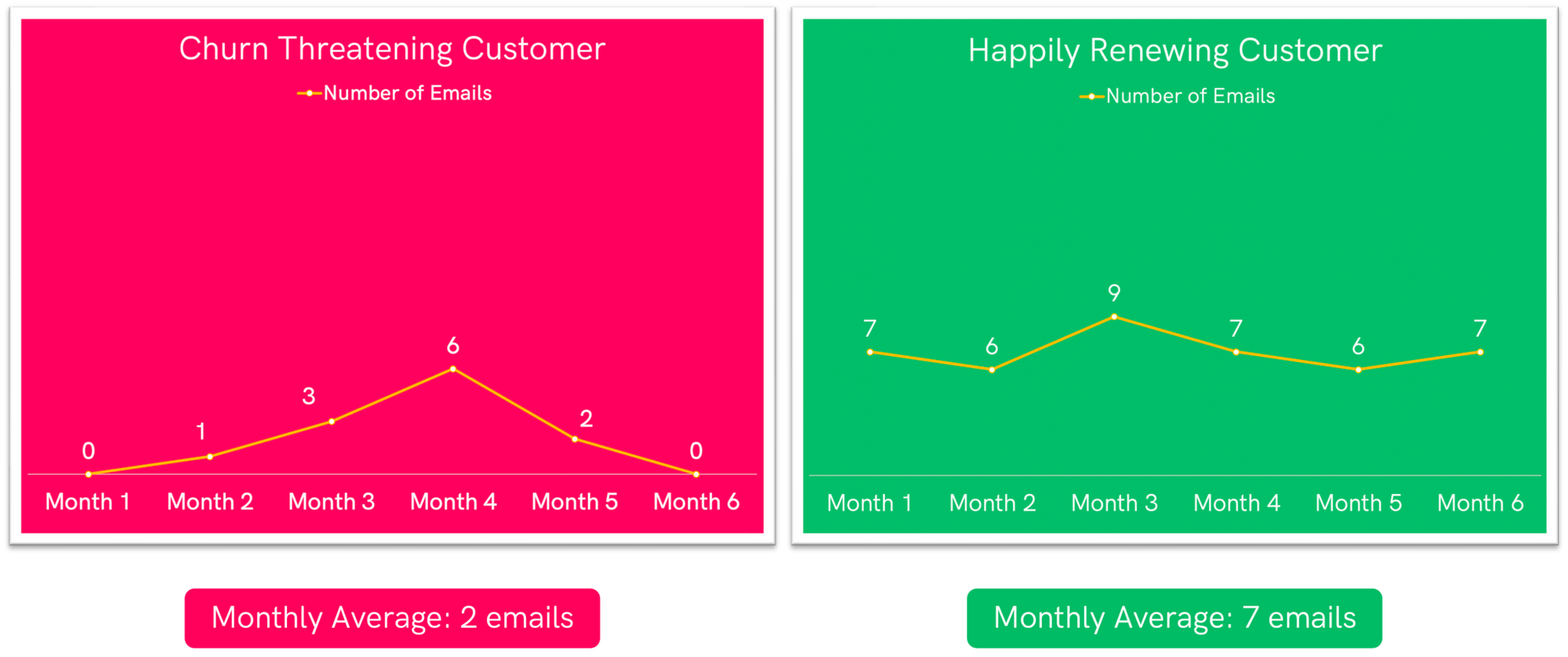

And then, we happened to look at their email track record with us. I am going to show you two customers’ data on the email side. See if you can spot the customer issue?

As you can see, the Churn Threatening Customer was in touch with us in a very erratic manner. They were off and on in touch with us. Their volume and consistency were both poor in talking to us 6 months prior to churning.

Subsequent interviews with the customer showed that they were restructuring their business and this change would make us redundant in their new scheme of things. Since they knew they would stop using us, they just remained silent for the period. We took their silence as a sign of having no complaints and missed the bus. This customer churned. However, the restructuring of their business didn’t go well and within 2 years they were bankrupt.

Learn From Churn: Lesson 6

In my next post, I will be giving an example of a churn threat where the customer’s use of our product features predicted a possible churn. Stay tuned.

ABOUT THE AUTHOR

Popular from Customer Health

Quality Content,

Straight To Your Inbox!

Subscribe for the latest blogs, podcasts, webinars, and events!

Write a Blog

If you have experience in CS and

a flair for writing, we’d love to

feature you.

Write to us on

hello@zapscale.com