CATEGORY > CS Metrics

Net Revenue Retention- Key indicator of a successful business

Introduction

Net revenue retention (NRR), also known as “Net Dollar Retention (NDR)”, is one of the most crucial key performance indicators (KPI) for SaaS and subscription-based companies. NRR is an important metric because it helps organizations measure customer retention along with the growth of existing customers. NRR is arguably the most crucial metric to define a business’s health and valuation.

Why Is Net Revenue Retention Important?

Net revenue retention is important because it measures how well your business is holding onto and growing existing customers.

Essentially, it tells you if you’re keeping customers happy and satisfied with your product and if they are spending more with your business over time.

High NRR means you are not just retaining customers but also expanding their value, think upsells, cross-sells, or just customer loyalty.

So, keeping an eye on NRR gives you a clear picture of your customer relationship and growth potential.

What Is A Good Net Revenue Retention In SaaS?

A good NRR in SaaS typically falls between 100% to 120%.

Hitting 100% means you are at least maintaining your current revenue from existing customers, which is amazing.

But if you are above 120%, you are not just keeping your customers happy, but you are also getting them to spend more.

Anything over 120% is fantastic and shows your customers are really seeking value in what you offer. Of course, what’s considered good can vary by company and industry, but aiming for above 100% is a great start.

How To Increase Net Revenue Retention Rate In SaaS Companies?

Increasing your NRR rate is crucial for a SaaS company.

NRR measures how well you are retaining and expanding revenue from your existing customer base, considering upgrades, downgrades, and churn. Here is a detailed approach to increasing your NRR:

1. Enhance Onboarding Process

a. Create a seamless onboarding experience for new customers so that they get easily started with your product. A well-designed onboarding process helps customers quickly understand and realize the value of your product.

b. Provide easy-to-follow guides, video tutorials, and FAQs to help customers navigate your product effectively.

2. Focus On Customer Success

a. Invest in a team dedicated to helping customers achieve their goals with your product. Their job is to understand customer needs and provide customized support.

b. Schedule periodic meetings with your customers to regularly check and assess how customers are using your product. Also, discuss their goals, and address any issues they may have.

3. Implement A Customer Feedback Loop

a. Use surveys, interviews, and product usage data to understand customer satisfaction and pain points. Regular feedback helps you make informed decisions about product improvements.

b. Use insights from customer feedback to make meaningful changes to your product or service. When you show that you listen and act on feedback - it builds trust and loyalty with your customers.

4. Optimize Upselling & Cross-Selling

a. Analyze customer usage and identify opportunities to offer advanced features or higher-tier plans that align with their needs.

b. If you offer complementary products or services, suggest them to customers based on how satisfied they are with your current offering.

5. Enhance Product Value

a. Regularly update and enhance your product to keep it relevant to your customers. This includes adding new features, fixing bugs, and improving usability.

b. Monitor and stay informed about industry trends and incorporate relevant innovations into your product to stay ahead of the competition.

How to calculate Net Revenue Retention?

NRR is a metric expressed as a percentage. It shows the amount (change) of revenue from current users that a company can retain compared to any other period.

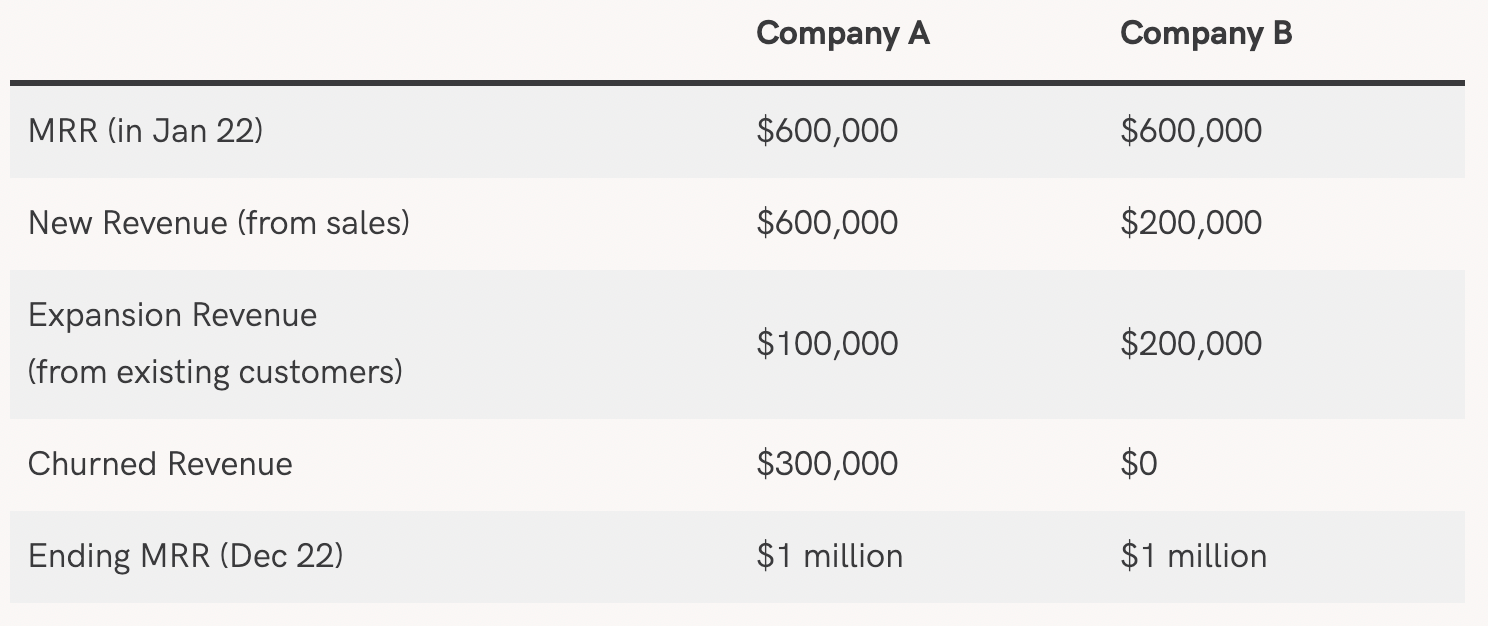

Let’s understand NRR with the help of an example – Company A and Company B over a period of 12 months (Jan 22 – Dec 22).

Ending MRR = Starting MRR (in Jan 22) + New Revenue + Expansion Revenue – Churned Revenue

Both companies began the year with $600k in monthly recurring revenue and ended the year with $1 million in revenue. From looking at absolute revenue numbers, the difference in the companies’ respective performance is not evident. However, looking at their individual NRRs paints a clearer picture.

Net Revenue Retention (NRR) = (Starting MRR + Expansion MRR − Churned MRR) / Starting MRR

NRR for Company A = ($600,000+$100,000-$300,000)/$600,000 = 66.67%

NRR for Company B = ($600,000+$200,000-$0)/$600,000 = 133.3%

Looking at the NRR, there is a significant difference in the companies’ performance.

NRR > 100% signifies that a business is growing healthily and that with time the revenue from existing customers is increasing. This is crucial for a SaaS business as the cost of acquiring new customers is very high. The CAC Payback or the time taken for a company to pay back the acquisition cost for a new customer for a typical SaaS company is ~15 months. Company A acquired new customers worth $600,000 but also lost $300,000 worth of revenue from existing customers. The amount of investment made by company A to recover the revenue lost from customer churn would be significantly higher due to the sales and marketing expenses involved in new acquisitions.

Benchmarks

Higher NRR provides more security to an organization’s future outlook. It also implies that the existing customer base is satisfied with a product.

Let’s take a look at the numbers from some of the top SaaS companies globally:

Twilio

Twilio is an American SaaS company, that provides programmable communication tools for making and receiving phone calls, sending and receiving text messages, and performing other communication functions using its web service APIs.

Twilio has consistently reported NRR around the 130% mark with an annual growth rate of ~40%. They are achieving these numbers with a base ARR of ~$2 billion!

Snowflake

Snowflake is another American public SaaS company that offers a cloud-based data storage and analytics service. Snowflake has been clocking 160% + NRR consistently over the last few years.

Private SaaS Companies

While it’s difficult to get hold of data for private SaaS companies, companies like Twilio and Snowflake set gold standards in terms of NRR and consistently growing their business.

If an organization has <$ 10 million in revenue, then the major focus is going to be on customer acquisition. At this point, it is critical for Customer Success Managers to ensure that the NRR remains above the 100% mark. Depending on the stage of business and type of the organization and product, there might be various avenues to grow revenue from the existing customers.

While most SaaS companies consider NRR as the ‘gold standard’ metric to track, there are some caveats to the picture this metric paints as it might not provide a holistic view of a business. This is especially true for early-stage startups.

Is NRR the only metric that matters?

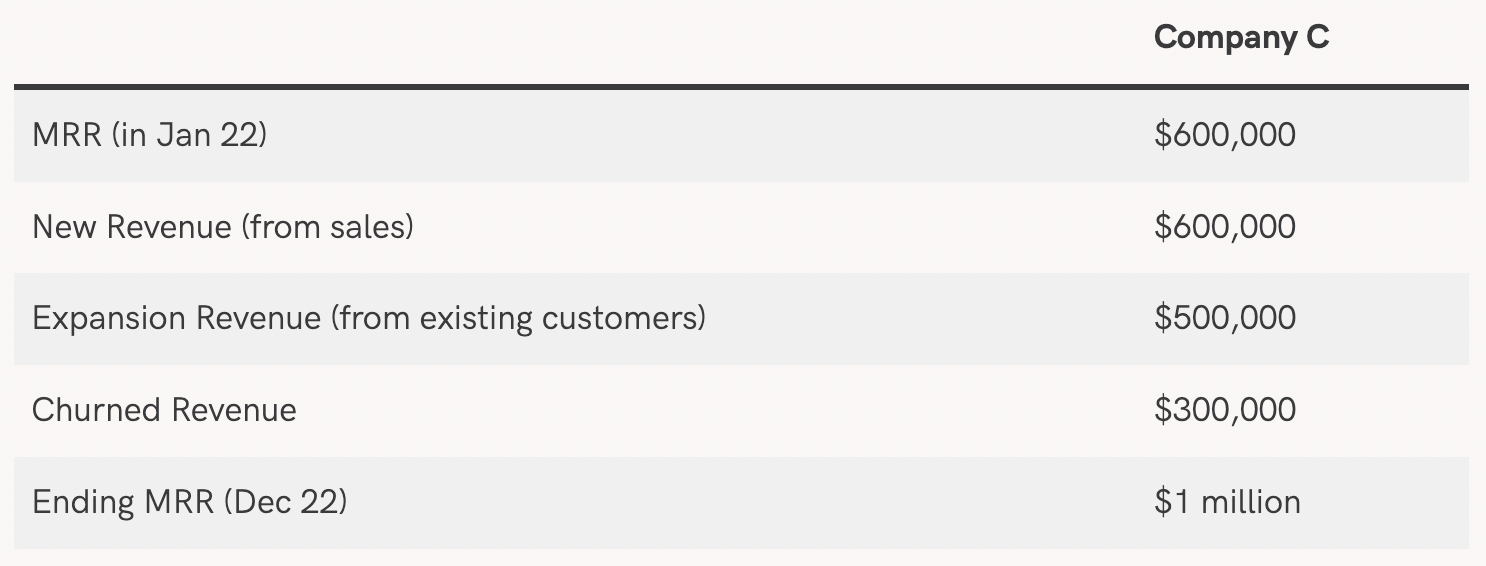

It’s very tempting for investors and founders to track NRR as the North Star Metric as it signifies the long-term health of your business. But sometimes just tracking NRR can be misleading, let’s take another example of an organization – Company C.

Company C’s NRR is >133% which is great on paper but something which really stands out in the above chart is the Churned revenue. Since the company’s revenue from expansion is very healthy, it veils a key concern about the organization’s overall health.

This is where another metric, closely related to NRR comes in handy – GRR or Gross Revenue Retention.

GRR is the percentage of recurring revenue retained from existing customers in a defined period, including downgrades, and cancels. It does not include the expansion revenue, and this is where it differs from NRR.

GRR = (Starting MRR − Churned MRR) / Starting MRR

Company C’s GRR = 50%

GRR is a great measure of a business’s long-term health as churn directly impacts long-term expansion opportunities. Assuming, Company C is losing 50% of its customers every year, then it has 50% fewer opportunities to increase the revenue from expansion.

This brings me to another critical metric, i.e., Net Logo Retention. As the name itself suggests, Net Logo Retention focuses on the number of customers using your product rather than just focusing on revenue numbers. This is another metric that might get overlooked for companies with higher NRRs but represent an important aspect of a business’s health.

80% logo retention for SMBs, 85% for mid-market, and 95% for enterprises are base-level benchmarks any organization must aim for to have sustainable growth.

How to improve GRR?

If your organization’s NRR or GRR is low, here are a few measures you can take to improve:

- Ensure your product experience is satisfactory, customers rely on 3 different outcomes while trying your product – Functional, Social, and Emotional. Making sure your customers’ functional outcomes are met is probably the most important but your business might be leaking revenue if the other outcomes are not met.

- Have the right teams in place to focus on expansion and churn. Most organizations introduce a Customer Success team late into their journey, but make sure you have a customer-first mindset early in the organization’s life. Customer Success teams should own Revenue Retention as their KPI. In some cases, Customer Success Managers own Expansion, but this can be owned by Account Management teams too.

- Track Customer Health Holistically – Customer Success Managers should track their customers’ health across various parameters. Tools like ZapScale help you track customer health across 150 key customer touch points and helps to paint a comprehensive picture of the overall business, customer, and user health.

Being proactive in managing your customers can help improve retention rates, which will directly influence your NRR and GRR numbers.

Conclusion

NRR is an important KPI for a SaaS organization’s long-term health. A healthy NRR indicates a growing and sustainable business. While NRR is important, it does not always paint the complete picture and it’s better to supplement NRR with complimentary metrics like GRR and Net Logo Retention.

ABOUT THE AUTHOR

Kshitij is a CS and Growth leader, who has championed customers across the globe at Zeda.io and MoEngage. When he's not doing that, he can be found trekking some mountain or practising calisthenics.

Popular from CS Metrics

Quality Content,

Straight To Your Inbox!

Subscribe for the latest blogs, podcasts, webinars, and events!

Write a Blog

If you have experience in CS and

a flair for writing, we’d love to

feature you.

Write to us on

hello@zapscale.com