CATEGORY > Customer Churn

How to Calculate Churn Rate for Unstoppable Growth

In a SaaS enterprise, metrics perform a key role in determining what’s working out and which aspects require special attention. Churn rate is one crucial metric for SaaS businesses as it helps them understand overall customer satisfaction and retention.

Today, we’ll learn everything about this superior metric and how to calculate churn rate for better business advancement. So, without any further ado, let’s begin.

The Basics Of Customer Churn Rate

Churn rate, also known as attrition rate, is a business term that measures the rate at which customers discontinue using a product or service over time. We express the churn rate in the percentage form for better interpretation.

For instance, if you have 100 customers and lose 10 of them over a year, your churn rate would be 10%.

This metric helps organizations assess how successfully they are retaining customers and if there's anything wrong with the specific product, service, or customer experience.

How To Calculate Churn Rate?

So, how to calculate the churn rate? You can apply this simple formula as mentioned below.

Churn Rate = Lost Customers ÷ Total Customers at the start of time period x 100

For eg,

Total No. of Customers during the initial period = 200

Lost Customers = 20

Applying the Churn Rate formula,

Churn Rate = 20 ÷ 200 x 100 = 10%

So, the churn rate is 10%.

The above method is the simplest way to calculate the churn rate. However, there are other methods too as mentioned below in brief.

Adjusted Churn Rate Method

Churn rate = churned customers ÷ average number of customers during the period x 100

For eg,

Customers at the start of March = 100

Customers at the end of March = 120

Churned customers = 10

Now,

Average number of customers = customers at the start of March + customers at the end of March ÷ 2

So, average number of customers = 100 + 120 ÷ 2 = 110

Churn Rate = 10 ÷ 110 x 100 = 9.09%

Hence, the churn rate is 9.09%.

Predictive Churn Rate Method

Churn rate = inactive customers ÷ customers at the beginning x 100

For eg,

Customers on 1st Sep = 100

Churned customers as of 1st Oct = 8

Applying the churn rate formula,

Churn Rate = 8 ÷ 100 x 100 = 8%

So, the churn rate is 8%.

Steps To Take After Churn Rate Calculation

Simply calculating the churn rate will not cut, the real work starts post-churn rate calculation.

Here are things you must do after quantifying your churn rate.

1. Scrutinize Customer Feedback

Look at reviews, surveys, or support tickets to figure out why customers are moving away from your business.

2. Perform Customer Segmentation

Divide your customer base into groups based on age, location, or purchase history to determine which groups have greater churn rates and modify your efforts accordingly.

3. Streamline Onboarding

Ensure new customers have a smooth and exciting onboarding experience. A solid start can surely help reduce early churn.

4. Connect With At-Risk Customers

Identify customers that demonstrate discontent or lowered participation. Reach out to them with exclusive offers or personalized assistance.

Real-World Examples Of Churn Rate

1. Netflix

Netflix had a large spike in churn rates after raising prices and removing popular content. But now this video streaming platform has a loyal user base with a churn rate ranging from 2.3% to 2.4%, while the broader market struggles with churn rates between 5.3% and 7%

2. Spotify

In 2021, Spotify had a churn rate of 3.9% which led to high costs due to heavy investment in marketing. However, by 2022, increased retention had reduced churn to 2.5% while stabilizing revenue. Churn fell to 2% in 2023, improving profitability with a lower cost of revenue (€9,850 million).

3. Adobe

Adobe's digital media segment has a turnover rate of less than 10% every year and a customer retention rate greater than 90%, indicating high customer satisfaction and retention.

Achieving The Ideal Churn Rate For SaaS Success

So, what’s a good churn rate? Technically, an ideal churn rate depends upon various factors like industry, business model, and company size. For well-established SaaS businesses, a churn rate below 5% annually is considered impressive.

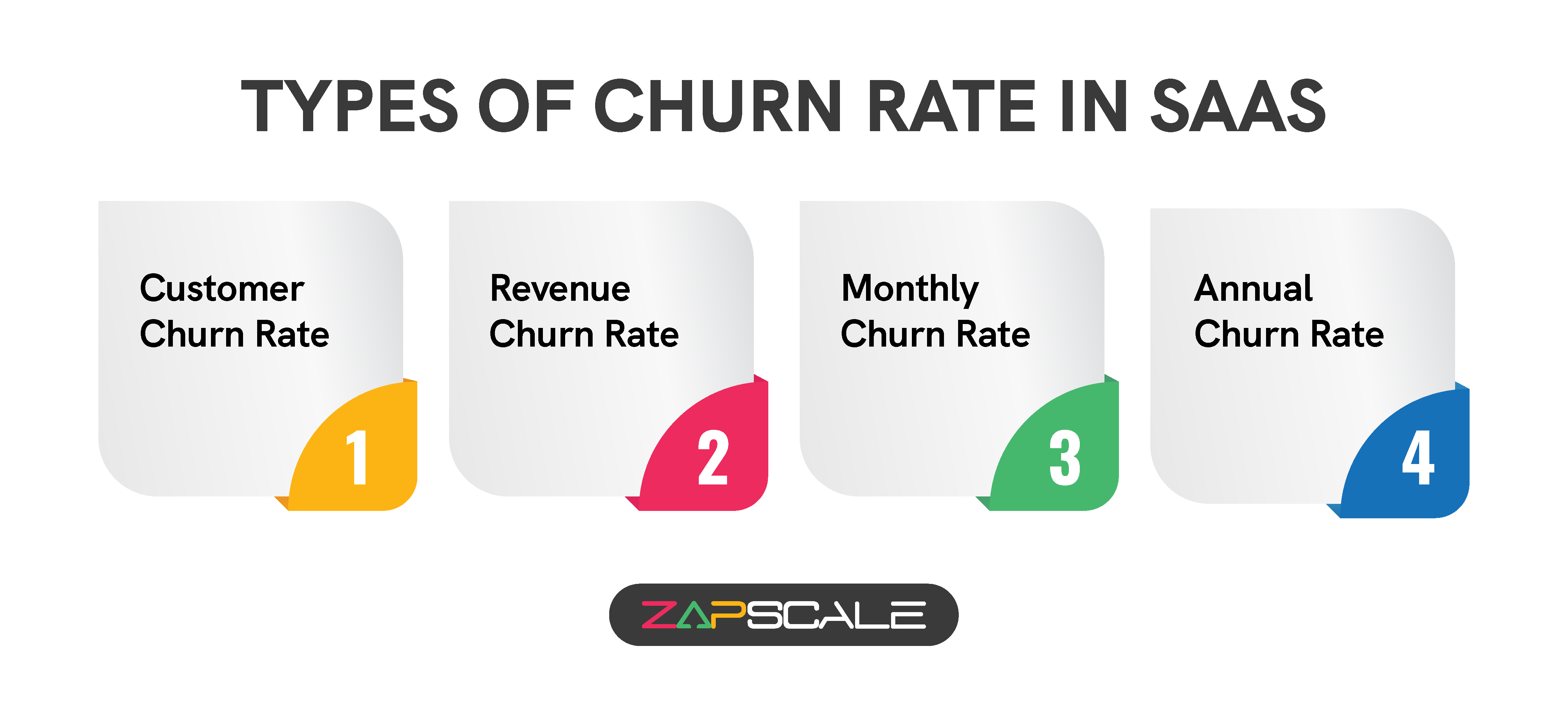

Different Types Of Churn Rate

There are several types of churn rates to help you gauge customer attrition. Let’s explore a select few as mentioned below.

1. Customer Churn Rate

This metric evaluates the percentage of customers who stop using your product/service during a particular period. It improves your customer experience and is vital for assessing how well you retain users.

2. Revenue Churn Rate

Assesses revenue loss as a result of existing customers downgrading or canceling their subscriptions. Critical for assessing how changes in customer behavior influence your revenue.

3. Monthly Churn Rate

Calculates the percentage of people who stop using a service within a month. Offers a short-term perspective on customer retention and product satisfaction.

4. Annual Churn Rate

Measures the percentage of customers that stop using a service within a year. Provides a long-term picture of customer retention and helps determine overall satisfaction and loyalty.

Customer Churn Rate v/s Revenue Churn Rate

1. Focus

- Customer Churn Rate: Highlights the number of customers who discontinue using your product/service.

- Revenue Churn Rate: Concentrates on the amount of money lost, irrespective of the number of customers.

2. Tracking And Reporting

- Customer Churn Rate: Frequently used in general reporting to monitor customer satisfaction and retention efforts.

- Revenue Churn Rate: Often used in financial reports to assess the efficacy of revenue retention tactics and anticipate future revenue.

3. Impact On Business Strategy

- Customer Churn Rate: Enhances customer retention strategies and customer service.

- Revenue Churn Rate: Facilitates fine-tuning of pricing strategies, increasing product features, and retaining high-revenue customers.

Essential Tools And Tips To TRack Customer Churn

1. Monitor Customer Accounts

Regularly track the number of active customer accounts and compare it to previous periods to analyze the number of lost accounts for calculating accurate churn rates.

2. Study Usage Patterns

Examine how people use your product or service. Significant shifts in usage patterns can indicate possible churn, allowing you to take action before it occurs.

3. Utilize Powerful Tools

Deploy effective solutions like Customer Relationship Management (CRM) to track customer interactions and pinpoint at-risk customers. Such tools provide accurate data on customer behavior and engagement levels. You can also use customer success solutions to monitor customer health scores based on usage, support tickets, and satisfaction levels. These technologies can help you predict churn and manage customer relationships better than ever.

4. Review Customer Feedback And Reviews

Analyze customer feedback and online reviews to detect frequent complaints or concerns. Addressing those issues can boost retention and reduce turnover.

Attrition v/s Churn

1. Scope

- Attrition: it usually Refers to the loss of employees or customers over time in corporate settings.

- Churn: Primarily used for customers and focuses on the loss of customers during a specified timeframe.

2. Measurement

- Attrition: Measured across extended periods, such as a year or several years.

- Churn: Measured across shorter time intervals, such as monthly or quarterly.

3. Frequency

- Attrition: Generally planned or anticipated and a regular part of corporate operations.

- Churn: Happens abruptly and unexpectedly, indicating serious concerns with customer satisfaction or product appeal.

4. Analysis

- Attrition: Analyzed to better understand long-term trends and ensure that losses are consistent with business objectives or industry standards.

- Churn: Analyzed to discover critical issues and design measures to reduce customer unhappiness and increase retention.

Slashing Customer Turnover With Flawless Churn Rate Calculation

In this highly competitive corporate world, ensuring a loyal customer base is indeed a crucial phenomenon. Calculating churn rate is not an easy task but it must be performed to identify common concerns associated with your problems with customer service, retention strategies, and product desirability.

Tracking how many customers exit over a month or year might help you identify problems with your customer service. Improving your support systems and investing in employees can help address these problems, resulting in a substantial fall in customer turnover.

FAQs

1. What tools can help track churn rate?

Robust tools like CRM systems, customer success solutions, and several analytics tools can assess customer interactions and predict churn.

2. What actions can reduce high churn rates?

You must optimize customer service, offer new product features, and invest in customer retention strategies.

3. What is a negative churn rate?

A negative churn rate occurs when revenue from upsells or expansions outweighs losses from cancellations, indicating an increase in customer value despite some churn.

ABOUT THE AUTHOR

Sonali is a social media enthusiast and creative content writer with 3+ years of experience. With a passion for storytelling, Sonali delivers content that inspires, informs, and captivate readers.

Popular from Customer Churn

Quality Content,

Straight To Your Inbox!

Subscribe for the latest blogs, podcasts, webinars, and events!

Write a Blog

If you have experience in CS and

a flair for writing, we’d love to

feature you.

Write to us on

hello@zapscale.com